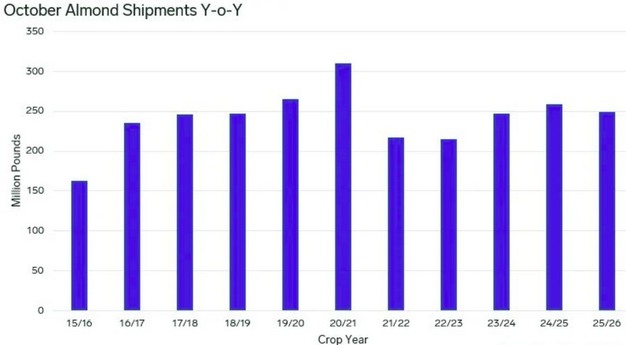

The Almond Board of California has released its October 2025 position report, showing total shipments of 249 million pounds, 3.6 per cent below October 2024 and slightly under pre-report estimates. Despite the year-on-year decline, the volume was above the three-year average and the highest October since 2020 aside from last season.

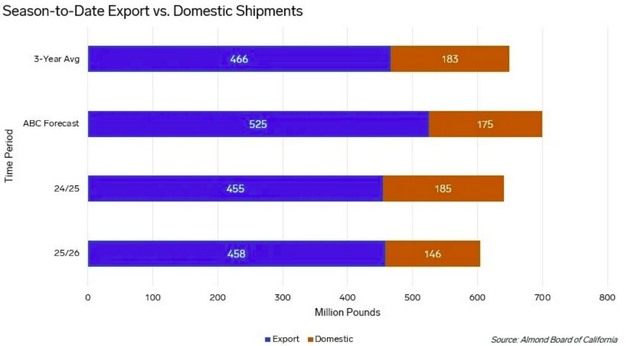

Season-to-date shipments from August to October reached 604 million pounds, 5.6 per cent behind last season and 7 per cent below the three-year average. Domestic shipments totaled 48 million pounds in October, down 28.5 per cent year on year and the lowest October since at least 2015. Exports reached 201 million pounds, up 5.2 per cent year on year and the strongest October since 2020. Export share stands at 75.8 per cent, above both the ABC forecast and the historical average.

© Mintec/Expana

© Mintec/Expana

India received 28.3 million pounds in October, bringing the season total to 72.2 million pounds, 29 per cent lower year on year. Europe took 58.4 million pounds, with 144.1 million season to date, up 29 per cent. The Middle East received 47.2 million pounds for a season total of 95.4 million, down 10 per cent. China and Hong Kong remained limited at 3.8 million pounds for the month and 6.4 million season to date, 75 per cent behind last year.

Total commitments were reported at 562 million pounds, 17 per cent below last year. New sales reached 262 million pounds, down 1 per cent year on year but up 19 per cent month on month.

© Mintec/Expana

© Mintec/Expana

Crop receipts total 1.698 billion pounds, with 706 million received in October. Last year's total at this point was 1.845 billion pounds. October receipts were 4 per cent lower than September, the first decline from September to October since 2022. It is unclear whether this indicates a smaller crop or reflects slower harvest progress. The three-year range for the percentage of crop received by the end of October is 54.5–68 per cent, with 2025 tracking within the range despite lower overall volume.

Market sentiment remains divided. Buyers highlight weak domestic shipments, reduced movement into India, and reports of softer European consumption due to higher prices. They also note the industry appears undersold entering the winter period. Sellers point to expectations of another year of lower supply, improved month-on-month commitments, and strong new sales. Some sellers have held back volume for later in the season due to crop uncertainty, while growers continue to hold firm on price because of high input costs.

Source: Mintec/Expana