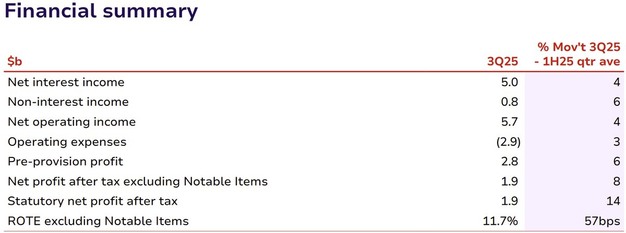

Westpac has reported an unaudited statutory net profit of US$1.9 billion for the third quarter of 2025. Excluding Notable Items, net profit rose 8% to US$1.9 billion and pre-provision profit increased 6%, with revenue up 4% and expenses up 3%. Impairment charges were 5 basis points of average gross loans. Capital, funding, and liquidity levels remain above regulatory requirements.

Chief executive officer Anthony Miller said: "This quarter, we delivered a sound financial result, while executing on our strategy and priorities. We grew strongly in business and institutional banking, while focusing on returns in Consumer and improving customer experience." He noted that customer service and access were expanded with new branches in Coomera and Darwin, five additional co-located branches, and investment in frontline bankers. AI technology is being piloted to improve real-time scam detection.

© Westpac

© Westpac

The bank highlighted that lower interest rates and moderated inflation have supported resilience in households and businesses, reducing customer stress levels. Miller said this should aid recovery in private sector activity and lending growth. The transformation agenda, including UNITE, BizEdge, and Westpac One, is aimed at simplifying operations and accelerating innovation, with UNITE activities now centralised under the Chief Transformation Officer.

Net interest income increased 4%, driven by a higher net interest margin (NIM) of 1.99%. Core NIM was 1.85%, up 5 basis points due to reduced liquid assets, proactive margin management on deposits, and stable to higher lending spreads. Treasury and Markets contributed 14 basis points to the NIM.

Customer deposits grew by US$10 billion, and gross loans increased by US$16 billion, including 1% growth in Australian housing loans (excluding RAMS), 5% in business loans, and 2% in institutional loans. Non-interest income rose 6% on stronger Markets revenue.

The Common Equity Tier 1 (CET1) capital ratio stood at 12.3% at 30 June 2025, above the target operating range of 11.0% to 11.5%. On a pro forma basis, CET1 was 12.0% assuming completion of the remaining share buyback, of which 71% of the US$3.5 billion program has been completed.

The quarterly average liquidity coverage ratio was 134% and the net stable funding ratio was 114%, both above minimums. Westpac has issued US$27 billion in long-term wholesale funding so far in 2025, completing its annual funding plan. Credit impairment provisions were US$5.1 billion, US$1.9 billion above expected losses in the base case scenario.

© WestpacFor more information:

© WestpacFor more information:

Hayden Cooper

Westpac

+61 402 393 619

www.westpac.com.au

Justin McCarthy

+61 422 800 321