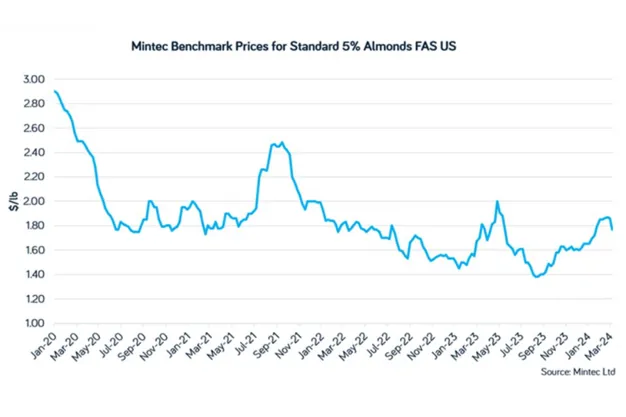

US almond prices fell last week with prices for standards moving below the $1.80/lb barrier for the first time in five weeks. The Mintec Benchmark Prices for standard 5% almonds FAS US were assessed at $1.77/lb on Thursday 7th March, in line with the last reported trade and down 9 cents/lb on the week.

The fall occurred across the wider almond complex with assessed items down between 3-12 cents/lb on the week. The decline was driven by a combination of bearish sentiment surrounding positive bloom conditions and increased availability, as more growers began to market almonds.

"We are seeing aggressive pressure from buyers this week with bids every day coming in lower everyday. European buyers are all citing positive bloom conditions and pointing towards a crop that could be at or above 3 billion pounds," a US trader disclosed to Mintec.

Currently the commonly stated production estimates reported to Mintec were in the range of 2.70-3.10 billion pounds, with sellers talking about a number close to 2.80 billion and buyers 3.00 billion.

Conditions have been positive since the start of bloom with one grower describing the situation as "night and day compared to last year". It is worth noting that it remains too early to draw firm conclusions on production from the current level of development, but it is a positive indication. "I used to waste my time trying to find any correlation between bloom conditions, bee flight hours and anything I could use to take the guess work out of production estimates at this stage of the season. I got nowhere with it, while conditions are looking good any production estimates that are coming out at this stage should be taken with a very large pinch of salt," a US handler stated.

Availability was also noted to have increased this week with an increasing number of call growers looking to move stocks to bring in cashflow. Market participants reported an increasing number of banks issuing final notices to lines of credit, which has forced growers who had been holding back stocks to return to the market.

"Cash reserves have been depleted over the past few years and growers, which were holding out for a boost to prices from a bad bloom, have been disappointed. Banks are also starting to lean on some growers to get cash in, which has led to those who have been holding stocks back starting to market again this week," a US handler said on Wednesday (6th March).

The recent bankruptcy of Trinitas Farming in February continues to remain a major discussion point for the industry. The private equity backed farming operation, which farmed a large acreage of almond orchards, filed for Chapter 11 bankruptcy protection on 19th February.

For more information: mintecglobal.com