Prices firmed in the US almond markets following a strong shipping performance in the December position report, which was released on 11 January.

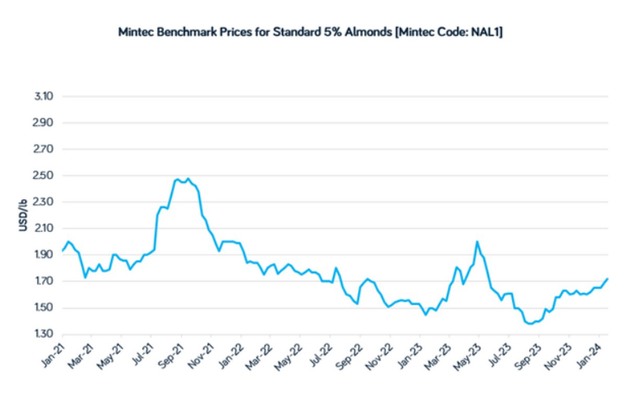

In the first assessment since the report, the Mintec Benchmark Prices for standard 5% almonds FAS US rose to $1.72/lb on 18 January, the highest value for the benchmark since May 2023. [Mintec Code: NAL1]

Despite the rise, prices still remain well below the cost of production for growers with one handler saying, “hopefully we can see a gradual return to profitability over the course of the year and start the new season being able to pay bills again.”

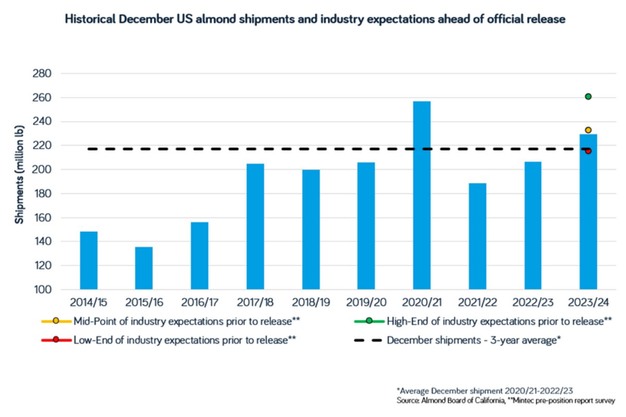

Shipments for December 2023 totalled 229 million pounds, the second highest December figure on record and a 11.2% year-on-year increase.

The figure was in line with industry expectations with market participants surveyed by Mintec prior to the release estimating December shipments in the range of 215-260 million pounds, with most respondents returning figures of 225-240 million pounds.

The full results of the Mintec Pre-Position Report Survey can be found via this link.

Season-to-date (August-December) shipments sat at 1.14 billion pounds, 10% above the same point last season and the highest shipments for this point in the season since the record shipment season of 2020/21.

Crop receipts came in at 2.23 billion pounds and based on the current situation most market participants were expecting final figures to come in 2.30-2.40 billion pounds.

“I wouldn’t expect more than 150 million pounds to come in over the next few reports and I wouldn’t be surprised to see as low as 50 million pounds over the next few months. With loss and exempt likely to be at around 4% by the end of the season, marketable production is going to struggle to get north of 2.30 billion pounds,” a US handler said to Mintec.

A production figure of 2.35 billion pounds less a 4% loss and exempt figure would place marketable production for the 2023/24 crop at 2.26 billion pounds.

“Crop receipts are low enough that it is starting to look like we might manage a return to profitability next season, if we can eat into the carryout and bring it down to 400-500 million pounds. Hopefully we can finally bring supply and demand back into balance by the end of this season,” a US exporter stated.

For more information: mintecglobal.com