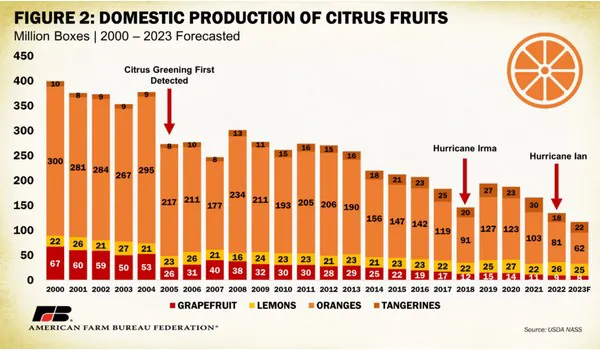

Citrus fruits account for 14% of total fresh fruit volume available to Americans, with oranges ranking fourth behind bananas, apples and melons in terms of per capita availability. Once leaders in citrus crop production, citrus farmers in the United States, particularly in Florida, have faced numerous challenges that have led to an unfortunate decline in domestic supply.

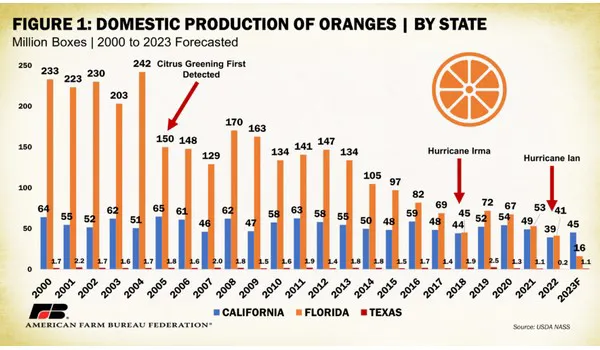

Four states, Florida, California, Arizona and Texas, have been overwhelmingly responsible for citrus production in the United States. Figure 1 displays the national production of oranges since 2000 by state. In the citrus industry fruit is often bought and sold by box rather than pounds or tons. This year is expected to be the first in which California produces more oranges than Florida, with California expected to produce 45 million boxes or 72% of all domestic oranges.

Before 2014, Florida consistently produced over 70% of the nation’s oranges. California’s commercial citrus crop is geographically immune to the impact of Southeastern hurricanes and has been spared from citrus greening thus far though detections in residential groves have sparked much concern. Drought conditions, and more recently high-precipitation events, have pressured orange yields in California, though production has held steady between 40 million and 65 million boxes since 2000.

Like oranges, grapefruit have seen a continuous drop in domestic production heavily linked to the weather and disease factors affecting Florida. Since 2000, domestic grapefruit production has dropped from 67 million boxes to 8 million boxes, an 88% decline. In 2000, 80% of domestically grown grapefruit was from Florida, followed by California (11%), Texas (8%) and Arizona (1%). In 2023, 51% of the much smaller projected crop is expected from California, followed by Texas (29%) and Florida (20%).

Source: fb.org