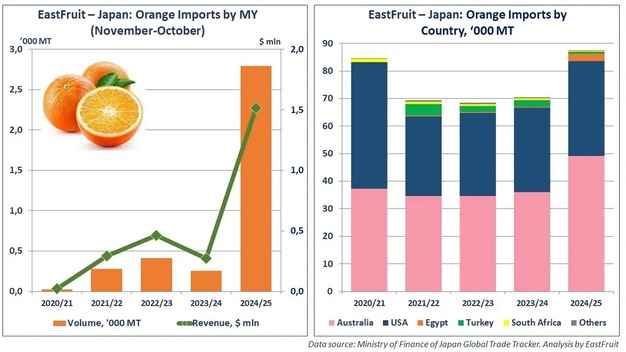

Egypt has expanded its orange exports to Japan during the 2024/25 season, increasing volumes more than tenfold compared with the previous year. According to data referenced by EastFruit, Japan imported 2,700 tons of Egyptian oranges between November and October, with a reported value of US$1.5 million. This volume is ten times higher than in the 2023/24 season and nearly three times greater than the cumulative shipments recorded before 2024/25.

Japan first began importing Egyptian oranges in the 2020/21 season, when volumes totaled 24 tons. Over a four-year period, exports have expanded more than one hundredfold, reflecting Egypt's growing presence in a market known for strict import protocols.

© EastFruit

© EastFruit

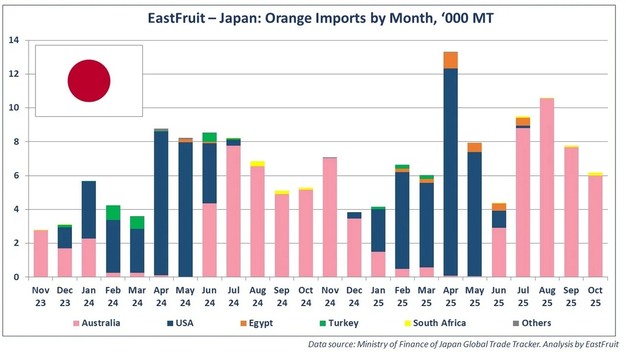

The Japanese orange market is largely dependent on imports, as domestic production covers less than 10 per cent of total demand. Supply is traditionally led by Australia from July to December and by the United States from January to May. Egyptian oranges enter the market mainly between February and July, placing them in direct competition with both origins.

The rise in imports during 2025 is linked to several structural factors. Egyptian exporters invested in meeting Japan's MAFF standards, allowing shipments to scale beyond trial volumes. At the same time, currency conditions reduced the competitiveness of oranges from the United States and Australia, creating room for alternative suppliers. Egyptian oranges entered the market at lower price points relative to traditional origins.

Volume reliability also played a role. Japanese supermarket channels require stable supply programs, and Egyptian exporters were able to deliver consistent volumes throughout the season. Improvements in grading and packaging supported the positioning of Egyptian oranges as table fruit rather than niche or technical imports.

© EastFruit

© EastFruit

By the end of the season, Egypt ranked among Japan's three main orange suppliers, surpassing Turkey and South Africa. This occurred during a period when Egypt's orange exports to other destinations declined, partly due to Red Sea shipping disruptions and stronger domestic demand from juice processors.

Beyond Japan, Egypt also increased its orange exports to Canada during the same season, adding to its export footprint outside traditional markets. While overall export dynamics vary by destination, developments in Japan and Canada indicate a shift in the geographic distribution of Egyptian orange shipments during the 2024/25 marketing year.

Source: EastFruit