The Administrative Committee for Pistachios released its shipment update on Jan. 15, 2026, covering the fourth month of the 2025/26 U.S. pistachio crop year. The season follows an on-year cycle, which typically results in higher volumes. All figures are reported on an in-shell equivalent basis, with kernel volumes converted using a 0.45 ratio to ensure consistency.

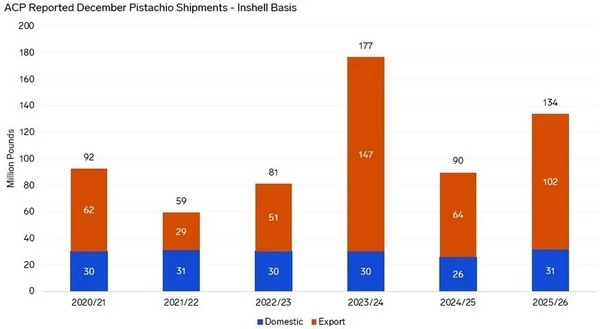

December 2025 shipments reached 133.7 million pounds, up 49.2 per cent year on year and 34.0 per cent above the five-year average. Export markets accounted for most of the increase, with shipments rising 60.6 per cent compared with December 2024, while domestic shipments increased 21.7 per cent. Export volumes totaled 102.3 million pounds, compared with 63.7 million pounds a year earlier. Domestic shipments reached 31.4 million pounds, up from 25.8 million pounds.

© Mintec/Expana

© Mintec/Expana

When compared with the previous year in December 2023/24, total shipments were lower. Export shipments declined by 30.3 per cent to 102.3 million pounds, while domestic volumes increased slightly to 31.4 million pounds. Total December shipments were 24.3 per cent lower than in the prior year.

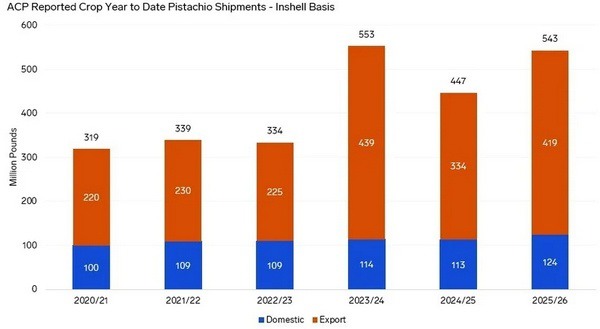

On a crop year-to-date basis from September through December, total shipments reached 543.0 million pounds, up 21.5 per cent year on year and 36.3 per cent above the five-year average. Export shipments totaled 419.1 million pounds, an increase of 25.5 per cent compared with the same period last season. Domestic shipments increased 9.5 per cent to 124.0 million pounds. Compared with the previous year, total shipments were down 1.7 per cent, reflecting lower export movement despite higher domestic volumes.

From a supply perspective, December receipts totaled 1.57 billion pounds, indicating that harvest deliveries for the 2025/26 crop year are largely complete. Receipts were 41.6 per cent higher than last season's off-year pace and 5.4 per cent above the prior on-year at the same point. With receipts leveling off, changes in supply are now driven mainly by inventory adjustments.

© Mintec/Expana

© Mintec/Expana

Adjusted inventory ended December at approximately 1.512 billion pounds, down 6.6 per cent month on month. Estimated marketable inventory stood at about 968.7 million pounds, a month-on-month reduction of 19.8 per cent after accounting for shipments and inventory adjustments.

Market participants report stable to firm pricing trends. While the U.S. crop is the largest on record, it came in below earlier projections. Smaller harvests in Iran and Turkey continue to influence global supply dynamics. As the season progresses, the combination of on-year volumes and declining accessible inventory is shaping market conditions ahead of the transition to the next off-year cycle.

Source: Mintec/Expana