"Peru's long production capacity is one of its major advantages. In many countries, the season lasts only a few weeks or months; in Peru, it can last five, six, or even seven months and continues to grow longer each year. This longer season enables better volume distribution and prevents concentrations that could pressure prices," stated Juan José Gal'Lino, CEO of Fruitist.

© Fruitist

© Fruitist

Today, Peru's market presence extends throughout most of the year, no longer confined to a specific window in the second half. "Currently, we operate almost year-round. There is still a peak in the second half, but we start earlier and finish later each year," explains Gal'Lino. This strategy enables volume growth without destabilising the market. "Prices are affected when the market is flooded with fruit in a few days. Here, it's spread over more days, benefiting the product."

Fruitist expects to end the 2025/26 season with about 32 million kilograms of blueberries, and grow by approximately 30% in the following season. This rise is primarily driven by the introduction of new varieties. "All the growth in Peru is happening with more modern varieties than those from 10 or 12 years ago, which are more accepted and command higher value," he stated.

© Fruitist

© Fruitist

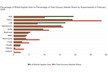

Segmentation plays a crucial role. "Today, blueberries are divided into multiple markets. There are conventional, premium, jumbo, and super jumbo categories, each with different price points," explains the CEO. This segmentation allows companies to target markets with specific demand, from the United States (which accounts for about 50% of exports) to Europe, China, and emerging markets such as the Middle East, India, and Turkey.

According to Gal'Lino, prices have stayed steady despite higher supply. "Although volumes increased, in the peak weeks, there was no more fruit than in other years. Supply has been orderly, and this has prevented major price drops."

© Fruitist

© Fruitist

Quality remains central to the strategy. "Preserving and enhancing quality holds greater value than merely producing more kilos," he emphasizes. Effective cold chain management and reducing logistical times from harvest to shelf are crucial for this.

The main future challenge is opening new markets. "Countries like Japan or Korea will be crucial for diversifying destinations and maintaining growth," Gal'Lino concluded, emphasizing that Peruvian leadership will only be sustainable if it is founded on quality, order, and a deep understanding of the consumer.

© FruitistFor more information:

© FruitistFor more information:

Juan José Gal'Lino

Fruitist

Tel. +51 1 421 3468

Email: [email protected]

https://www.fruitist.com/