The U.S. table grape market has experienced an exceptionally strong start to the import season following an abrupt end to the California grape campaign. California supply of both green and red seedless grapes tightened sharply in the last quarter of 2025, particularly for high-quality fruit. As a result, market conditions throughout November, December, and into early January were highly favorable for imported grapes.

In a good year, California ships through December, but most shippers concluded their seasons in October already, with only limited volumes extending into November and early December. Even among those late shippers, maintaining retailer-grade quality proved challenging due to rain damage and the advanced age of the fruit. As a result, pressure shifted quickly to imported supplies, primarily from Peru.

Peru drives elevated early-season pricing

"For most of December, imported green seedless grapes traded at historically high levels," says Dalton Dovolis with International Produce Group (IPG). Sweet Globe™ grapes were commonly sold between $38–$43 for premium quality, with some brands reaching higher. Autumncrisp® on the other hand ranged from $40 to over $50 in some open-market transactions, depending on quality and program commitments. Red seedless grapes—typically less in demand than green varieties—also experienced strong pricing, generally ranging from $38–$43, with premium-quality Sweet Celebration™ and similar varieties reaching the upper end of that range. Of course, there were exceptions to the low and high end of the ranges.

Market tightness intensified to the point where, in some cases, even Category 2 Ivory and sugarone grapes traded above $40, driven by early rain impacts in Piura in Northern Peru and delayed starts in Ica in the south. "Overall, import quality varied widely by region and variety, producing a broad spread between top-tier and marginal fruit," Dovolis said. Market conditions proved to carry even the marginal quality for the majority of December.

Despite higher cumulative arrivals, the market has not yet fully normalized at this point. An estimated 70–75 percent of weekly volumes have effectively entered the system, as port releases were delayed following the Christmas and New Year holidays. This logistical lag helped keep pricing relatively firm into early January.

© International Produce Group

© International Produce Group

Pricing normalizes as volume builds

As weekly arrivals increased through January, pricing began to normalize from December's extreme highs, though premiums continue to be paid for exceptional quality. "Sweet Globe grapes are now generally trading in the mid to high $30s, with exceptional quality lots still reaching around $40. Autumncrisp remains one of the strongest items in the market, commonly selling between $38–$43, with standout fruit achieving prices above that range." For red seedless grapes, pricing has softened more noticeably. Program business is now typically transacting in the high $20s to low $30s, while the open market continues to see sales in the mid to high $30s, and in select cases higher, depending on quality, variety, and destination.

Navigating early season tightness

"At IPG, we successfully navigated the early-season supply shortage through long-standing relationships with California growers that extended high-quality domestic supplies into November and early December," Dovolis mentioned. This continuity allowed IPG to bridge the gap before imported volumes became more consistent, at a time when quality fruit was increasingly difficult to source.

In parallel, IPG's established partnerships in Piura provided early import coverage, followed by the transition into Ica, where quality has improved materially as the season has progressed. Piura has now virtually completed harvest, with approximately 97 percent of fruit shipped. Ica on the other hand, is estimated to be 20–22 percent complete and running roughly 10–12 days behind schedule, depending on the growing area.

"We are now fully focused on our IPG Gold Standard program, working closely with a trusted Peruvian grower to pack high-spec Sweet Globe and Autumncrisp grapes." This program makes its full circle as it was just launched from California as well. The program emphasizes size, crunch, flavor, and visual appeal, with fruit packed to meet premium retail and foodservice requirements. Rather than volume at this stage we are aiming to deliver the most exceptional box of grapes to the American Consumers.

© International Produce Group

© International Produce Group

Chile begins seasonal ramp-up

In the meantime, Chile has begun the 2025/26 table grape season with a slightly stronger start compared to last year. Week 1 shipment volumes tracked above the same period in the previous season. Thus far, the U.S. market accounts for roughly 75 percent of Chile's early exports, which is typical during the opening weeks. However, Chile remains a relatively small contributor to current U.S. supply. Total shipments from Chile to the U.S. are down approximately 23 percent year-to-date, with roughly 450,000 boxes shipped, representing no more than six percent of total market volume over the past two weeks.

Smaller volumes are currently moving to the Far East, Europe, Canada, and Latin America. Asia, in particular, is receiving less Peruvian fruit this season, as U.S. demand has absorbed a larger share of both Peruvian and early Chilean supply.

February and March will be the market's true test

Barring weather or logistical disruptions, Chile appears positioned for a gradual and orderly increase in volume, with more meaningful shipments expected from mid-January onward as core varieties and broader exporter participation come online.

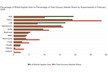

Meanwhile, Peruvian exports remain strong. Peru is currently eight percent ahead of last year, with over 58 percent of shipments destined for the U.S., totaling approximately 30 million boxes, up 13 percent year-over-year. Green seedless grapes represent 53 percent of Peru's export mix, led by Sweet Globe (24%) and Autumncrisp (12%).

While pricing has begun to settle into more sustainable levels as arrivals increase, the real inflection point will come in February, when peak Peruvian volumes converge with expanding Chilean supply. How effectively the market absorbs this combined flow will determine pricing trends and momentum through the remainder of the southern hemisphere season.

© International Produce Group

© International Produce Group

For more information:

For more information:

Dalton Dovolis

International Produce Group (IPG)

Tel: (+1) 831-754-9740

[email protected]

www.internationalproducegroup.com