The updated price report for week 1 shows a stronger opening compared with the same period of the previous season. For producers and exporters, the main reference points are how the price is evolving relative to volume, the differences between destination markets, and the performance of organic shipments. The report notes that adjustments may still occur in the coming weeks as data continues to consolidate.

Week 1 delivers an improved average FOB price for blueberries compared with the start of the previous campaign. However, this performance is largely influenced by exports to other destinations, which recorded the highest prices on a very limited volume of only 9 tons. As a result, this outcome is not representative of overall market behaviour or of destinations handling larger volumes. Monitoring upcoming weeks will be necessary to determine whether this price level can be sustained or whether values adjust as volumes increase.

The report adds an important methodological note, stating that data for the last six weeks is still provisional. Averages, minimums, and maximums may therefore be revised as reporting is finalised. This reinforces the need to interpret week 1 results with caution and to maintain consistent comparisons between campaigns.

In the historical comparison, the 2025/26 season is currently slightly above the weighted average of 2024/25, while 2023/24 remains higher overall. Beyond averages, the value of the report lies in weekly dispersion, highlighting how wide price ranges can be depending on timing and volume intensity.

Week 1 typically acts as a reference point rather than a conclusion. If prices hold, trading activity tends to intensify, and conditions for program execution improve. If prices are correct, attention shifts toward selective execution, where target markets, turnover speed, and fruit condition define achievable returns.

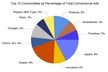

The report confirms that FOB blueberry prices differ widely by destination. The United States remains structurally important due to scale, Europe and the United Kingdom follow their own pricing patterns, and China can register higher prices in specific weeks. Other destinations show more competitive behaviour, with occasional price spikes that may support diversification strategies.

For exporters, these destination gaps influence export timing, program development, quality thresholds, and logistical coordination to ensure arrival conditions. During transition weeks, these differences often become more pronounced.

The organic segment continues to display higher average prices combined with greater variability. Performance in this category depends on consistency of supply, condition, and traceability, particularly while recent data remains subject to revision.

The report also points to smaller-scale destinations showing attractive FOB prices at this stage. These opportunities may suit niche strategies if evaluated alongside logistics costs, condition risk, and commercial requirements. Overall, week 1 reinforces that value is driven by the interaction of destination choice, timing, and execution.

Source: Blueberries Consulting