Market sources report an oversupply in the European potato market, pushing prices down as demand for free-buy trading remains limited.

In 2025, potato plantings in the EU-4 countries (Belgium, Germany, France, and the Netherlands) rose 7.5% year-on-year. According to the North-Western European Potato Growers (NEPG), this expansion was driven by the belief that "we need all the potatoes we can get". High free-buy prices at the end of 2023 and 2024 "led farmers to think that low prices could never happen again". Sources added that "prices of fries have been sky high…and everyone felt that the situation would last."

French fry sales have become more challenging. The NEPG said, "Exports of frozen chips and other potato products started slowing down already last year. Conditions on the world market have deteriorated."

The NEPG noted that European growers are increasingly exposed to global competition. "Competition from Asian markets is real, with China and India having increased their exports tenfold in five years. European prices for frozen chips and other processed products, mainly due to higher energy and freight costs, are higher than Canadian, and even more Chinese or Indian ones."

As the new season begins, much of Europe remains heavily contracted. Sources reported that in January-February, processors agreed contracts at high price levels from previous years, but by March-April, it became clear they had "contracted too much at too high a price".

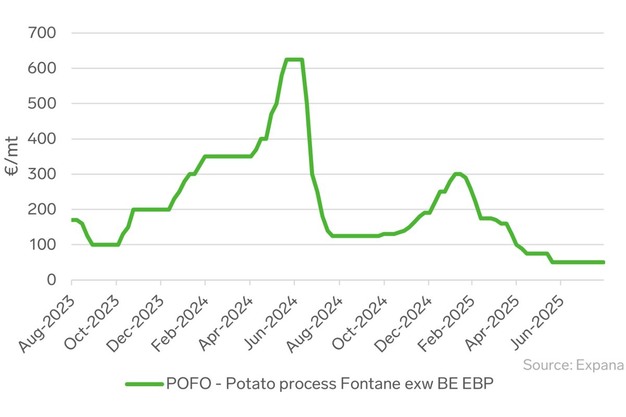

By mid-June, Expana Benchmark Prices (EBP) for Fontane processing potatoes exw Belgium stood at €50/mt (US$54/mt), compared with €625/mt (US$676/mt) in mid-June 2024. Prices have remained stagnant since, with little free-buy activity reported.

Historic early plantings this year added pressure, as old crop stocks overlapped with early arrivals of the new crop. Although hot and dry weather has affected parts of Europe in recent months, sources believe the impact on yields will not be enough to ease oversupply. "Yields seem to be more than okay. Even a loss of 10-15% wouldn't make much difference," market participants told Expana.

The NEPG added: "Collaboration between the different European stakeholders in the potato value chain is essential to improve our competitiveness. Growers probably overestimated the long-term profitability of potato growing and should open their eyes to the multiple limits before governments intervene with even more legislation."

Source: Mintec/Expana