Market participants in the UK potato sector are managing two concurrent issues: reduced demand for packing potatoes and the threat of a drought that could influence the 2025/26 Marketing Year (MY) crop yields if realized.

The UK's potato trade remains suppressed, with high availability and low demand. Many traders are covered by contracts for the rest of the 2024/25 MY. Warm temperatures have led to decreased potato consumption, and any trading has been focused on high-quality products with good baking attributes.

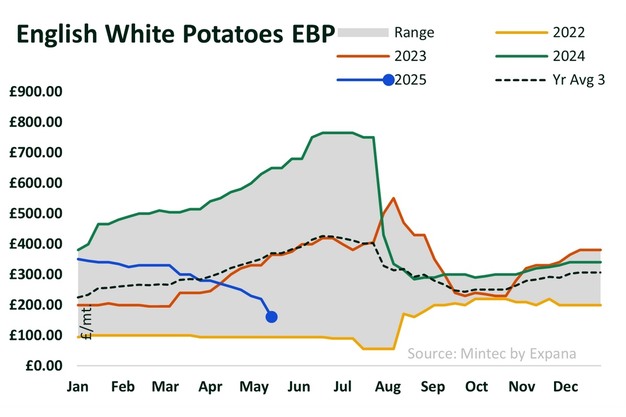

This has led to a steep decline in prices. As of May 20, Expana's Benchmark Price (EBP) for Maris Piper pk exw Eng stood at £160 per metric tonne (mt), marking decreases of 44.8% month-on-month (m-o-m) and 76.1% year-on-year (y-o-y). A similar trend was observed for the white pack exw Eng, with its EBP also at £160/mt, declining by 40.7% m-o-m and 75.4% y-o-y. The severe y-o-y declines are attributed to increased crop availability and larger contracted volumes, a response to the previous scarcity and high prices.

With planting for the 2025/26 MY completed and supported by dry weather, an early crop is anticipated. Irrigation is, in effect, minimizing current stock demand and further impacting prices. However, planted potatoes are in the tuberization phase, reliant on adequate water. Although growers have benefited from dry conditions, there are growing concerns over a possible drought. This uncertainty is affecting market sentiment, with reports suggesting potential price drops to double digits, a first in three years.

Source: Mintec/Expana