Over the past decade, Morocco has become one of the most active players in the global blueberry market. In the 2024 campaign, Moroccan blueberry exports reached around 74,000 tons, a 15% increase compared to 2023, according to data from the Moroccan Interprofessional Federation of Fruits (FIFEL). Export revenues exceeded US$500 million, driven mainly by European demand for low-impact, health-oriented products.

What began as an experimental initiative in the Larache and Loukkos regions in the early 2000s has developed into a commercial sector covering more than 7,500 hectares of blueberries in 2025, with a target of 10,000 hectares by the end of the decade. The country currently exports over 95,000 tons of fresh fruit annually (96,193 tons, 27% more than the previous season), consolidating its position as Africa's leading exporter and a key global supplier.

European market focus

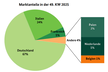

Morocco's proximity to Europe provides a major logistical advantage, allowing freshly harvested fruit to reach markets such as the United Kingdom, Germany, France, and Spain within hours. Transport costs remain lower than those of competitors, including Peru, Mexico, and Chile.

International companies such as Driscoll's, BerryWorld, and SanLucar have established operations in northern Morocco through partnerships with local producers. These collaborations have introduced post-harvest management systems and precision irrigation technologies, helping raise productivity above 12 tons per hectare for fruit destined for the fresh market.

Water management and climate challenges

The sector's continued expansion faces limits due to water scarcity. Morocco is among the Mediterranean countries most affected by climate change, with declining rainfall and aquifer depletion in key production zones. To maintain blueberry production, the government has promoted irrigation efficiency under the Generation Green 2020–2030 strategy. Producers are adopting drip irrigation, satellite monitoring, and the reuse of treated water to align export growth with environmental sustainability.

Global competition and diversification

Morocco competes directly with Peru, Chile, Mexico, and Spain, which have consolidated supply chains and strong access to European retailers. Morocco's export window, between January and May, allows it to serve the European market when South American volumes decline. However, profit margins remain under pressure due to international price competition, rising transport costs, and strict EU phytosanitary requirements. Exporters are therefore exploring new markets in the Middle East and Asia, including the United Arab Emirates and China, to reduce dependence on Europe.

Outlook to 2030

The Moroccan Ministry of Agriculture projects that blueberry cultivation could exceed 9,000 hectares by 2030, with exports approaching 120,000 tons annually. Supported by Tangier Med port infrastructure and trade agreements with the EU and UK, Morocco aims to strengthen its role as a North African agro-export hub. The long-term challenge will be to sustain competitiveness while managing water use responsibly and adapting to climate change.

Source: Blueberries Consulting