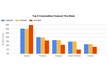

As Zespri and Driscoll's increase their presence in China, both companies are focusing on market development in lower-tier cities. This shift is attributed to changing retail channels, livestreaming trends, and a broader base of urban consumers outside first-tier cities.

Driscoll's has partnered with the streaming platform iQiyi and its program Let's Farm, which features young participants running a real farm and selling produce via livestreaming. "The show's audience is mainly young people aged 18 to 25 in smaller cities, making it a perfect platform for us to build brand familiarity and trial," said Henry Yoon, marketing director of Driscoll's China.

"In the past two years, our sales growth rate in lower-tier cities has outpaced that of first-tier cities," Yoon added. Driscoll's is targeting cities where retail centers and premium outlets are seeing higher engagement compared to more saturated top-tier markets.

New Zealand-based Zespri is implementing a "widen and deepen" strategy. "If a city used to have 100 retail points for our kiwi fruit, we aim to increase that to 150 or more," said Leo Li, e-commerce manager. He noted that despite importing 1.4 billion kiwifruits into China in 2023, household penetration remains low.

Zespri operates in 72 cities and 55,000 stores and aims to expand supply to over 60 million standard boxes by 2028. The company works with e-commerce platforms including Tmall, JD, Douyin, and Meituan to reach wider consumer segments.

"Cities below the second-tier level, starting from third-tier cities, represent a vital frontier for our mid to high-end positioning," Li said.

"China's breadth and depth are extremely attractive. Even in mature markets like Shanghai, where our household penetration is about 45 percent, there's still room to grow," Li added.

Source: ECNS