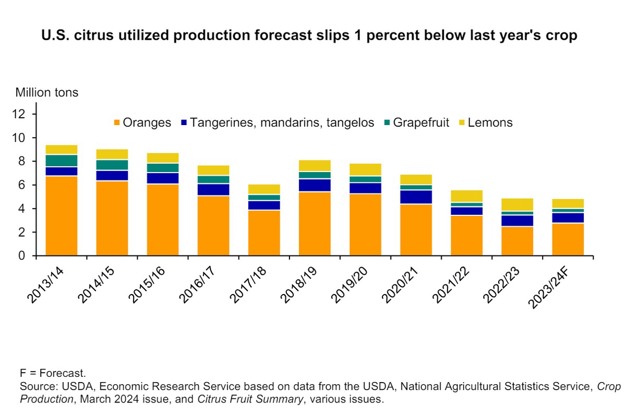

The most recent U.S. citrus crop forecast (March 2024) for 2023/24 is 4.85 million tons, down 1 percent from the 2022/23 final utilized total of 4.9 million tons. The March 2024 USDA, National Agricultural Statistics Service (NASS) Crop Production report forecasts that domestic producers will grow 2.77 million tons of oranges, an 11 percent increase from final production in the 2022/23 season. Grapefruit production is expected to reach 340,000 tons, up 4 percent from 2022/23.

Lemon production, 95 percent of which is supplied by farms in California, is expected to decrease by 25 percent, from 1,116,000 tons in 2022/23 to 836,000 tons in 2023/24. Tangerine production is expected to decrease by 7 percent, from 971,000 tons in 2022/23 to 904,000 tons in 2023/24.

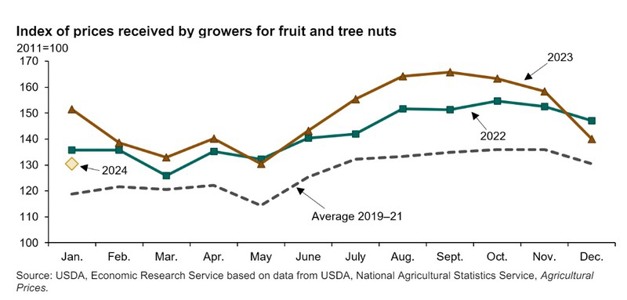

Fruit and tree nut grower prices lower in early 2024

Fruit and tree nut grower prices fell in late 2023 and early 2024. In January 2024, the index of prices received by growers for fruit and tree nuts was 130.5 (2011=100), approximately 3 percent below the average January index from 2022–23, but 10 percent higher than the average index from January 2019–21.

In the September 2023 Fruit and Tree Nuts Outlook report, USDA, ERS documented steady decreases in almond, walnut, and hazelnut prices from their record highs in the mid-2010s through the 2022/23 marketing year. Recently collected trade data from the U.S. Department of Commerce, Bureau of the Census suggests that prices remained low through the start of the 2023/24 marketing year. Industry expectations about high tree nut yields in 2024/25 (bolstered by improvements in weather during almond pollination and the availability of water in California during the spring) are expected to put downward pressure on prices late in 2023/24.

Click here to read the full report.

Source: ers.usda.gov