In the summer of last year, early pre-harvest forecasts called for a larger apple crop compared to the previous season. Given that supply outpaced demand during the 2024/2025 season, a production increase prompted many marketers and retailers to build aggressive fall promotional programs to ensure timely movement.

"However, once harvest was complete, the industry quickly realized the original forecast was materially overstated," says Don Roper with Honeybear Marketing. With retail programs committed well in advance, fall and early winter movement was exceptionally strong across multiple varieties. This accelerated sell-through caused several varieties to become oversold early in the marketing season at lower price points, creating supply risk for late spring and summer coverage. "By the end of December, it turned out the industry had sold proportionally more during the first quarter of the new season."

The tightening of supply is driven by three primary factors:

- A smaller-than-expected total crop.

- Weaker packouts on several varieties compared to last season.

- Increased export demand as multiple international growing regions have experienced short crops.

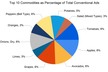

"The only way to slow demand and manage inventories to avoid premature sellouts is to adjust the price," shared Roper. As a result, pricing has strengthened across many varieties. However, some key varieties have already outpaced the supply assurance levels needed to support the 2026 crop year, including Gala, Honeycrisp, Cosmic Crisp, and Red Delicious.

© Honeybear Marketing

© Honeybear Marketing

Summer inventories are tightening

While the Honeycrisp crop is up approximately 10 percent versus last season, aggressive fall sell-through has tightened inventories to the point that Honeycrisp is now projected to run out as early as July. Gala production is down nearly 25 percent year-over-year, with no meaningful relief expected. For both Honeycrisp and Gala, import opportunities do exist to help maintain summer coverage, though those options may not fully offset the short domestic supply.

Cosmic Crisp continues to see exceptionally strong movement, and with Washington remaining the only domestic source, summer inventories are tightening rapidly. As a result, some retailers are expected to face shortages of Cosmic Crisp heading into fall.

Red Delicious sales have also exceeded expectations this season, driven by stronger domestic and export demand combined with reduced industry supply after years of orchard removals. All four of these varieties are experiencing significant upward price movement, a trend that is expected to continue through spring and into the summer months.

Small (organic) fruit in high demand

Granny Smith, Pink Lady, and Fuji are experiencing a different set of challenges—both positive and negative. These varieties skewed heavily toward a larger fruit size this season, and while Granny Smith production is slightly above normal, Fuji and Pink Lady are down approximately 17 and 15 percent respectively, versus last year. Demand for larger sizes remains soft, keeping pricing weak in those varieties. Conversely, with fewer small sizes available in the manifest, small fruit and bagging sizes have seen significant upward price pressure.

These same sizing dynamics are directly impacting organic programs as well. Small organic fruit for retail bag programs is in particularly high demand, and for certain varieties—most notably Organic Gala and Organic Pink Lady—supplies are unlikely to carry through the summer. Organic Honeycrisp is the exception, as strong supplies remain available across both large and small size profiles. The strained position on several organic varieties will also lead to an increase in organic imported apples into the U.S. this summer.

© Honeybear Marketing

© Honeybear Marketing

Orchard profitability still under pressure

"In general, we are seeing increased producer pricing into retail," commented Roper. While stronger pricing will help offset lower volumes for growers, in many cases it still does not translate into favorable orchard economics. Washington's apple industry continues to face significant economic headwinds that are pressuring orchard profitability, including rising labor and production costs, a higher cost of capital, and ongoing periods of excessive supply. "These forces are actively reshaping the industry," said Roper.

For more information:

For more information:

Don Roper

Honeybear Brands

[email protected]

www.honeybearbrands.com