India's pomegranate sector has enjoyed three strong years, with both production and farmer interest on the rise, says pomegranate farming agronomist Sushant Survey. "Around 90% of the country's pomegranate area is concentrated in Maharashtra, Gujarat, Rajasthan, and Karnataka, with Maharashtra still leading in terms of both planted area and quality, while Gujarat and Rajasthan are catching up as growers shift out of traditional crops like cotton and sesame into higher-value fruit." He notes that most orchards are planted with the Bhagwa variety to meet both domestic and export demand. Maharashtra can supply pomegranates almost year-round thanks to different flowering cycles, while the main season in Gujarat and Rajasthan typically runs from November to May.

© Anarking AgriTech

© Anarking AgriTech

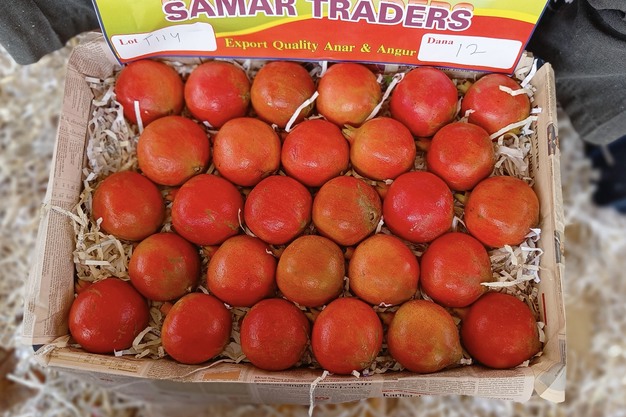

Sushant estimates that Maharashtra accounts for roughly 52% of the pomegranate plantation area, Gujarat about 40%, and the remainder is split between Rajasthan and Karnataka. "Larger farm sizes in Gujarat, where orchards can run from 5 to even 100 acres, have enabled growers to scale up quickly and earn more, especially as prices have stayed attractive. For the past three years, average farm-level prices for export-grade fruit have been in the range of USD 1.1 to 1.8 per kg. Maharashtra attracts USD 2.4 per kg for better fruit quality, while Gujarat attracts slightly lower but lucrative rates depending on size and quality."

Quality profiles differ by region, which also influences market preference, Sushant mentions. "Pomegranates from Maharashtra are generally favoured for their combination of size, colour, juice content and sweetness, and command the strongest demand in wholesale hubs of major metro cities compared with arrivals from Gujarat and Rajasthan. Gujarat pomegranates offer good juice content but often lag in size and shelf life, making them less suitable for distant markets. However, fruit coming from the Bhuj area of Gujarat can match Maharashtra's in terms of export quality. Rajasthan fruit looks attractive but is usually weaker in sweetness and juice, which limits its appeal beyond certain domestic channels."

© Anarking AgriTech

© Anarking AgriTech

Sushant observes that exports are driven by market choice rather than just production standards. "Bangladesh has become an important destination for Indian pomegranates, regularly absorbing large daily volumes at prices close to those for other export markets. Bangladeshi buyers pay high rates and import around 15 to 20 tonnes a day from a single farmer, so for the last 2 to 3 years, many farmers have focused on that trade instead of strict residue-free production." This shift goes hand-in-hand with climate change pressures, he adds. "Growers who once supplied residue-free fruit to Europe now find it harder to stay within residue limits as higher pest and disease pressure forces more sprays."

Even then, Sushant believes residue-free programmes and long-distance sea exports to new markets such as the USA, Australia, and Canada will remain important growth areas. "Recent five-week sea shipments of Indian pomegranates to the US East Coast have shown that, with the right variety and careful post-harvest handling, Indian pomegranates can travel further while maintaining quality. For growers, the challenge now is to balance reliable, nearby demand from markets like Bangladesh with residue-free and shelf-life requirements in high-value distant markets."

For more information:

Sushant Survey

Anarking Agri Tech

Tel: +91 84 84 825 411

Email: [email protected]