Over the past year, Ivan Marambio, president of Frutas de Chile, has travelled to China five times, including a two-week visit in January, reflecting continued engagement with Chile's largest fruit export destination.

"I am trying to keep track of my periodic visits to China," Marambio said, referring to the frequency of travel required to follow market developments in the country.

China remains Chile's main fruit market. "China is our biggest market," Marambio said. "We are sending almost 40 per cent of all the fruit Chile exports to China. In the case of cherries, about 90 per cent comes here." Frutas de Chile represents more than 200 exporting companies and is focusing on expanding consumer understanding and consumption in the Chinese market.

"Now, we want to take the relationship with Chinese consumers to the next level," Marambio said. "We are investing in strategies to get closer to the consumers and better understand what they want. But this is not only about investing money — it's about investing in growing consumption. We want to grow our relationship with Chinese consumers in all the ways that we can. We want cherries to become part of everyday life, expanding how and when people enjoy them."

Bilateral trade

According to Pablo Arriaran, trade between Chile and China has expanded steadily since the Chile–China Free Trade Agreement took effect in 2006. "Bilateral trade reached US$61.66 billion in 2024, 8.6 times the level in 2006, representing the highest per-capita trade value between China and any South American country," Arriaran said.

Cherries remain central to this trade. During the 2024/25 season, Chile exported nearly US$3.3 billion worth of cherries to China. "With their auspicious red color conveying the warmth of the Chilean sun during China's winter, cherries have become a symbol of the close ties between our two countries," Arriaran said.

Export volumes have declined this season, with shipments down 12.1 per cent compared with the same period last year. "The market this year is a little bit different," Marambio said. "We had an early harvest, so the season is 7 to 10 days ahead of schedule. We expect a slightly lower volume than last year during January and February."

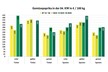

Market data indicate price adjustments. At the Beijing Xinfadi wholesale market, imported cherry prices fell from 36 yuan per 500 g, about US$5.2, in 2024 to 26 yuan in January 2026. Sunhola Gaobeidian wholesale market reported a shorter supply window due to weather conditions and early harvesting in Chile, with shipments expected to decline in February.

"The core advantage of our fruit comes from the quality of the fruit that Chile offers to the world," Marambio said. "That is our main strength, and we grow with quality, and our members adapt to how the market behaves."

Source: ChinaDaily