The Orchard Business Analysis 2024 Actual and 2025 Forecast report indicates that the model orchard is expected to return to a small net trading profit in 2025, marking the first positive result since 2020. The forecast improvement is linked to a modest lift in yields and packout, although rising input costs continue to constrain overall returns.

The Orchard Business Analysis program uses a model orchard based on real data from 22 contributing businesses. The model represents a 40-hectare apple and pear orchard, with a variety mix guided by the national orchard census and crop forecast. While yields, packouts, and price assumptions for 2025 are comparable to those seen in 2020, higher production and operating costs are expected to limit the size of any surplus.

© APAL

© APAL

In 2024, the model orchard achieved a gross yield of 42.7 tons per hectare, slightly below forecast and 15.6 per cent lower than the record model yield of 50.6 tons per hectare recorded in 2022. Seasonal variability affected results, including hot and dry conditions in parts of New South Wales, Western Australia, and Tasmania, wetter conditions in Victoria and Queensland, and hail events in some regions.

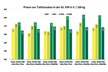

Class 1 packout across all varieties rose to 67 per cent in 2024, compared with 61 per cent in 2023. Class 2 accounted for 14 per cent of volume, with the remaining 18 per cent directed to processing. Despite the improvement in packout, lower gross yields, reduced Class 1 volumes, and higher costs resulted in the lowest cash operating surplus recorded by the model since the program began in 2008.

The report shows that average Class 1 yields in both 2023 and 2024 were below 30 tons per hectare, a level identified as insufficient to support sustainable returns. Break-even analysis indicates that, for Pink Lady apples in 2024, a Class 1 packout of at least 70 per cent was required at a gross yield of 50 tons per hectare. For Royal Gala, break-even scenarios ranged from 60 tons per hectare at 70 per cent Class 1 packout to 40 tons per hectare at 80 per cent Class 1 packout.

For 2025, gross yields and Class 1 volumes are forecast to increase slightly. Average Class 1 yield across all varieties is expected to reach 31 tons per hectare, supporting a return to a cash operating surplus and a small net trading profit for the model orchard.

The analysis highlights continued variation between average and upper-quartile performers. Upper quartile businesses generated cash operating surpluses of just over US$37,000 per hectare in both 2024 and the 2025 forecast, while the rest of the group recorded a deficit in 2024 and near break-even results in 2025. Differences were linked to higher packout, pricing outcomes, and management practices, including infrastructure, timing of operations, staff capability, and variety selection.

© APAL For more information:

© APAL For more information:

APAL

Tel: +61 3 9329 3511

Email: [email protected]

www.apal.org.au