Global processed tomato production in 2025 is estimated at about 40.3 million metric tonnes (mt), down 12% year-on-year (y-o-y) from 45.8 million mt in 2024, according to figures published by the World Processing Tomato Council. Despite the drop in output, inventories remain elevated after record production in 2023 and 2024, enabling some producers to offer competitive prices in the global market.

The overall decline in production is driven mainly by reductions in China and the European Union, while the United States recorded an increase in output.

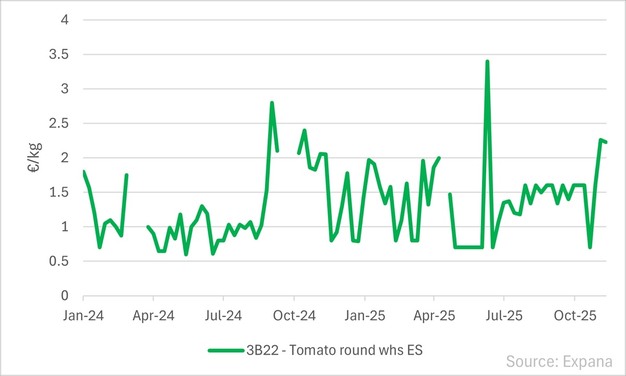

In Spain, adverse weather conditions, including heatwaves in summer 2025, contributed to lower processing volumes. The WPTC estimates a 22% y-o-y decline in Spanish processing production for 2025. In the Spanish market, prices for round tomatoes stood at €2.23/kg on 19 November (latest available data), up 39.4% quarter-on-quarter and 8.8% y-o-y. Converted to US dollars, €2.23/kg is approximately US$2.40/kg at current exchange rates.

© Mintec/Expana

© Mintec/Expana

Italy, by contrast, recorded a 7% y-o-y increase in processing tomato output in 2025, with volumes reaching 5.7 million mt, allowing it to hold the position as the world's second-largest producer. Despite higher production, Italy's export performance weakened over the course of 2025. Market sources indicate that US import tariffs and heightened global competition affected Italian shipments, which traditionally serve the premium segment, particularly in North America. Price competitiveness is expected to remain an area of focus for Italian producers in the year ahead.

China's processing tomato output is estimated to have fallen significantly in 2025, with volumes around 4.9 million mt, representing a 53% y-o-y decrease from 2024. With existing inventories carried into 2025, China was able to offer competitive pricing in export markets, reflecting the impact of earlier production surpluses.

In the United States, the state of California reported production of 10.65 million mt in 2025, up 18.75% compared with its five-year average. California accounted for 26.4% of global processing tomato production in the latest estimates. Higher yields in the state supported price competitiveness, and sources indicate exploration of export opportunities beyond the traditional markets of Canada and Mexico.

Although sources expect producers to draw down inventories this year, current high supply levels continue to influence price competition in global trade. This dynamic presents challenges, especially for EU producers facing relatively high production costs and regulatory requirements that affect cost structures in comparison with some international suppliers.

Source: Mintec/Expana