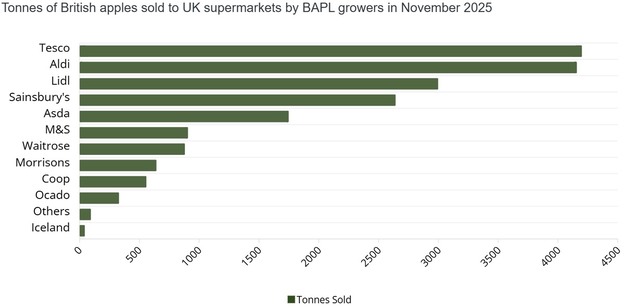

British apple sales through UK supermarkets in November 2025 show a clear concentration among a small number of major retailers, with Tesco and Aldi leading the market by volume. Both chains accounted for the largest tonnages of British apples sold by BAPL growers during the month, reinforcing their role as the primary outlets for domestic apples. Lidl and Sainsbury's followed at some distance, while Asda formed the second tier of volume buyers. The remaining retailers took notably smaller quantities, highlighting how dependent British apple throughput remains on a handful of large supermarket programs.

© British Apples & Pears

© British Apples & Pears

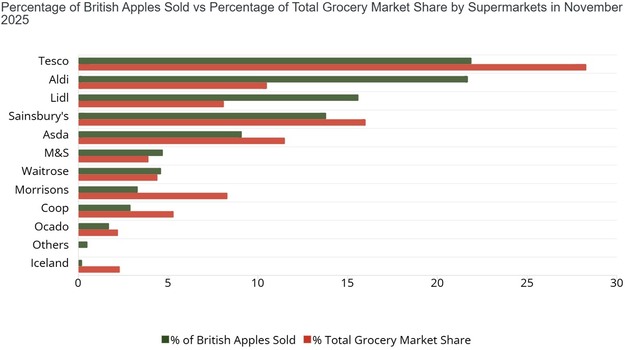

When volumes are compared with overall grocery market share, differences in retailer sourcing strategies become more visible. Tesco's share of British apple sales broadly aligns with its dominant grocery position, while Aldi stands out as taking a higher proportion of British apples relative to its overall market share. Lidl shows a similar pattern, punching above its grocery weight in British apple procurement. By contrast, Sainsbury's and Asda take a lower share of British apples compared with their total grocery presence, continuing a trend seen in previous seasons.

Premium and convenience-focused retailers show more mixed behaviour. M&S and Waitrose account for a modest share of British apple volumes, broadly in line with their smaller grocery footprints, while Ocado remains a niche outlet for British apples despite its growing role in online grocery. Morrisons and the Co-op both take less British apple volume than their grocery market shares might suggest, a pattern that has been noted in earlier British apple sales analyses.

© British Apples & Pears

© British Apples & Pears

At the lower end of the scale, Iceland and the "Others" category contribute minimal volumes to British apple sales, underlining the limited role of some value and specialist retailers in supporting domestic production. Overall, the November figures again illustrate that sustaining British apple sales depends less on broad market participation and more on the sourcing commitments of a small number of high-volume retailers, a recurring theme in recent British apple market reporting.

© British Apples & PearsFor more information:

© British Apples & PearsFor more information:

British Apples & Pears

Tel: +44 (0) 1507 353778

Email: [email protected]

www.britishapplesandpears.co.uk