In marketing year (MY) 2024/25, avocado production in Chile increased to 240,000 metric tons (MT), up 60 per cent from MY 2023/24, supported by favorable climatic conditions and higher rainfall. Production is forecast to remain unchanged at 240,000 MT in MY 2025/26, assuming stable yields and no change in planted area.

© USDA

© USDA

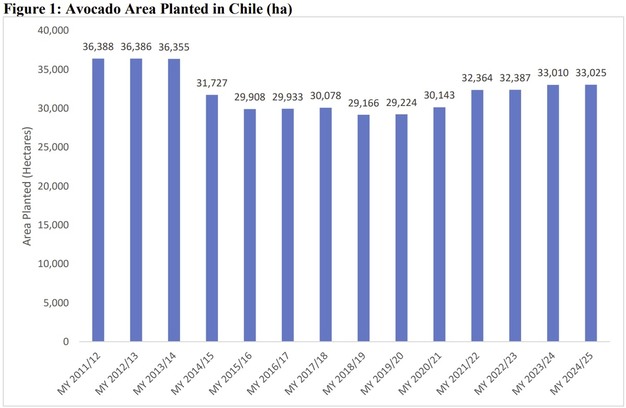

The total avocado area planted in MY 2024/25 stood at 33,025 hectares, largely unchanged year on year. Production spans from the Coquimbo region in northern Chile to the O'Higgins region in the central south. The Valparaíso region remains the main producing area, with 20,434 hectares, representing 61.9 per cent of the total planted area. The Metropolitan, Coquimbo, and O'Higgins regions also account for notable shares. Over the past three marketing years, planted area has expanded across all producing regions.

Despite the continuation of a multi-year drought, winter rainfall in MY 2024/25 was well distributed and above average, contributing to improved yields. According to the Chilean Avocado Committee, production between July 2024 and June 2025 reached 240,000 MT, compared with 150,000 MT in MY 2023/24.

© USDA

© USDA

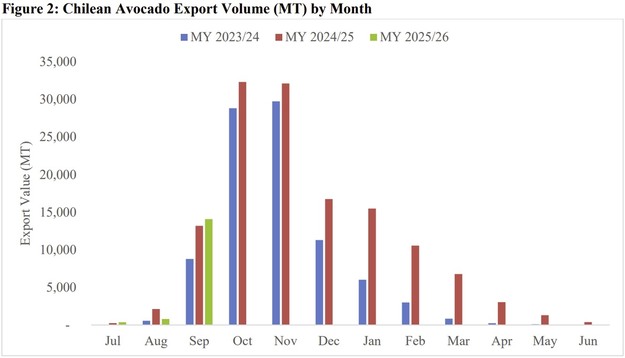

Exports increased sharply in MY 2024/25, reaching 134,255 MT, a 50.3 per cent rise from the 89,346 MT exported in MY 2023/24. Export volumes during the first three months of MY 2025/26 totaled 15,232 MT, slightly below the 15,550 MT recorded in the same period a year earlier.

Argentina was the largest export destination in MY 2024/25, accounting for 21.7 per cent of shipments, followed by the Netherlands at 19.1 per cent, Spain at 12.3 per cent, and the United Kingdom at 11.3 per cent. Export values rose to US$364.4 million, up 58.6 per cent from US$229.7 million in MY 2023/24.

© USDA

© USDA

Avocado exports typically peak between October and November, aligning with the main harvest period. Unit export values tend to be highest between April and July, when Chilean supply is lower. During the early months of MY 2025/26, from July to September 2025, unit values were lower than in previous years, reflecting increased production and export availability.

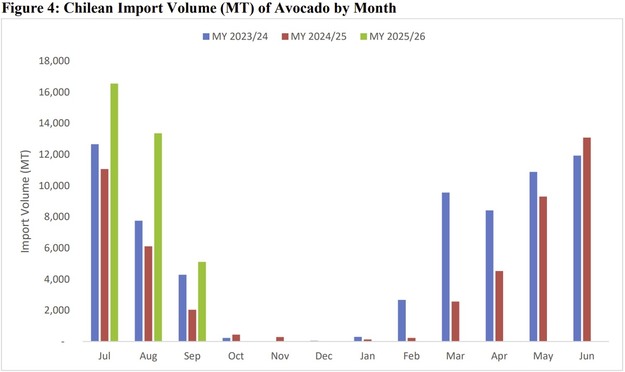

Imports declined by 27.6 per cent in MY 2024/25 to 49,751 MT, driven by higher domestic supply. Peru remained the primary supplier, accounting for 99.8 per cent of import volume. Import values totaled US$74.9 million, down 33.7 per cent from MY 2023/24. Avocado imports generally peak between May and August, when domestic production is limited.

To view the full report, click here.

For more information:

For more information:

USDA

Tel: +1 202 720 2791

Email: [email protected]

www.apps.fas.usda.gov