The traditional launch of the French apple pear campaign took place last week in Paris, organized by the French Apple Pear Association (ANPP). For French apples, the campaign looks promising, especially given the situation in Europe. For pears, the priority is now to diversify varieties and develop orchards. Producers, wholesalers, and distributors also discussed the issue of prioritizing the French origin, which is essential to the success of this new campaign.

French apples: A clear market and export opportunities

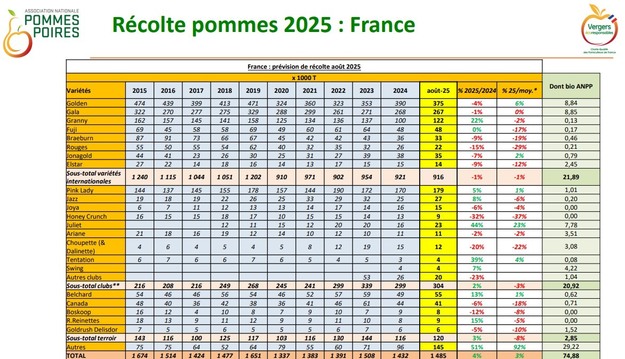

The national forecast for apples is 1.485 million tons, which is 4% more than in 2024 and 3% more than the five-year average. Production is "slightly above average, without being excessive," explains Vincent Guérin, in charge of economic affairs at ANPP, adding that forecasts are likely to change due to the pressure of the ash aphid, which is very strong this year. Golden apples are above average but slightly down from last year. The Gala variety is back to normal, as is the Granny Smith after a dip last year. International varieties are stable (-1%). Club* varieties (Cosmic Crisp, Pink Lady...) continue to grow (+2%, to 300,000 tons), thanks to new orchards. Finally, the so-called "terroir" apples are showing contrasting results. The Chanteclerc and Belchard are in line with the average, with a better harvest than in 2024, while the Canada variety remains weaker.

*gross harvest and not harvest under specifications

This year's harvest will be more plentiful, thanks to the absence of climatic events (frost and drought), and it will be "more qualitative than last year, thanks to a higher sugar content," explains Christophe Belloc, chairman of Blue Whale. "This year's supply will therefore be sufficient to cover the markets, with a quality that gives us hope that consumers will find it particularly attractive to consume, and come back for more."

On July 1st, European stocks stood at 340,000 tons, which is 90,000 tons less than last year. The market is therefore clear, even if French stocks are slightly higher than last year. At the same time, the arrival of apples from the southern hemisphere stood at 146,700 tons at the end of week 34, which is a higher level than in the last two campaigns, dominated by Chile, South Africa, and New Zealand.

This should create opportunities for French apples, especially as the European harvest remains small for the second year running, at 10.455 million tons, which is equivalent to 2024. Poland is up slightly, but is still well short of its potential, while several Central European countries (Hungary, Romania, Croatia, and Slovakia) are experiencing a sharp shortfall due to frost. Italy is down slightly, but in line with its average; Germany is back to normal after a poor harvest, and Spain is down, but in line with its average. Turkey, too, saw its production severely reduced by the spring frosts. The sector is therefore hoping to maintain the export momentum observed last year. After the historic low point of 2022-2023, French apples performed well in 2024-2025, gaining 10,000 tons. The European market remains the leading outlet for French apples, while the Far East has been growing for the past two years. The Middle East and America, on the other hand, are still struggling.

"We have the capacity to serve the demand of the French market, so the French origin must be favored for the campaign to be successful," insists Christophe Belloc, calling on downstream distributors to promote French apples. While the retailers present all renewed their commitment to the French origin, Lidl France, following the departure of Michel Biero, warned that the shelf would be managed differently, but that the chain would promote French produce. "We have been taken in hand by the parent company, so it is true that we now have a less clear vision, but we will not abandon French products. We will do it differently, with less emphasis and more profitability on the shelf."

For organic apples, production is expected to rise slightly compared with last year (Italy is down and Germany is up). After seeing a decline in the quantities purchased and the sums spent, the market appears to be stabilizing across the 3 distribution channels, with consumption expected to pick up slightly in 2025. However, we have observed a decrease in prices at departure sites, which are getting closer to conventional prices.

French pears: A varietal calendar consistent with French origin

For the 2025-2026 season, ANPP forecasts 140,000 tons of pears, a "satisfactory" level, above average, and slightly up from last year. After a large harvest of summer pears in 2024 (Guyot variety, in particular), the trend is reversed in 2025, with a 5% drop in the summer segment and a larger harvest of autumn and winter pears, especially the Conference variety. At the European level, the harvest is estimated at 1.622 million tons (+2%). But the situation differs from country to country: Italy is down by 25% (sharp drop in Abate), Portugal remains far from its potential, while the Netherlands (+8%) and Belgium are recovering from a low point in 2024, with a smaller harvest for summer pears (-14%).

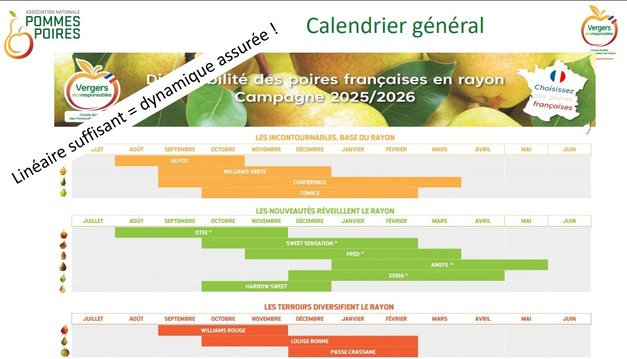

French production is still marked by a steady decline in yields due to the vagaries of the weather and technical difficulties, but almost 500 hectares have been planted over the last seven years. ANPP is therefore working on a partnership with the downstream sector to support the diversification of varieties and the development of orchards. This partnership will also help to boost the pear segment, and will take the form of a varietal calendar "consistent" with the French origin, with "an offer available until the end of January. The aim is to work with distributors to develop promotional operations that are consistent with the production calendar, and to improve the identification of the French origin and Eco-responsible Orchards label," explains Vincent Guérin. In practical terms, we want to ensure that 2 classic varieties are regularly available on the shelves, combined with 2 other varieties, in order to provide consumers with diversity and to boost consumption.

Additionally, for the campaign to run smoothly, a promotional calendar is also being developed. "Promotions need to coincide with production peaks. There is no point in pushing consumption in September and having no pears left in December. French production does not cover all requirements," explains Bertrand Gassier, producer and chairman of Château de Nages Fruits, for whom French varietal diversity is a real asset. "The pear is the 6th most popular fruit in France, so diversification is a great opportunity to express yourself and stand out commercially, especially in France, which is the only country in Europe to have genuine varietal diversity, unlike the monoculture of Conference pears in the Benelux or Rocha pears in Portugal." He also called on retailers to prioritize the French origin. "We have at least two million consumers who reject Acetamiprid [editor's note: the "No to the Duplomb law" petition posted on the National Assembly website at the beginning of July had attracted more than 2 million signatures] and we are the only country in Europe not to use it, so retailers should give exclusivity to French pears while they are available."