The Netherlands is expecting an increase in apple and pear production in 2025 following a season of favorable growing conditions. Apple output is projected at 226,000 metric tons, up 17 percent from 2024, led by Elstar, Jonagold, and Kanzi varieties. Pear production is forecast at 348,000 metric tons, with Conference pears making up about three-quarters of the total. The harvest is expected to reach the market by late August.

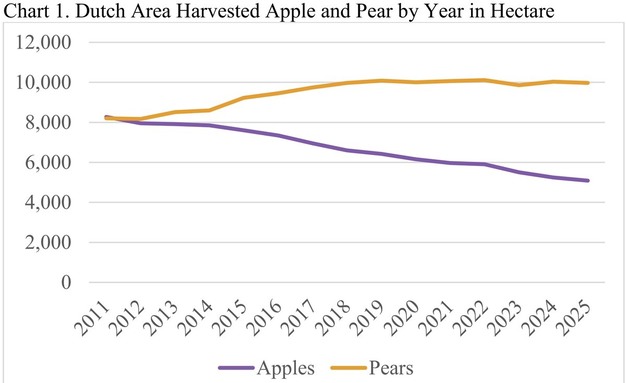

Apple acreage has continued to decline, dropping to an estimated 5,086 hectares in 2025, three percent lower than last year and about one-third of the area planted 25 years ago. This reduction is linked to declining profitability, reduced generational succession, pesticide restrictions, and high replanting costs. Despite this, yields have increased due to favorable weather.

© USDA

© USDA

Pear acreage has expanded over the past decades, stabilizing at around 10,000 hectares since 2018. In 2025, it is projected at 9,969 hectares across more than 1,100 farms. Approximately 40 percent of these farms also grow apples or other fruit crops.

The Elstar apple is expected to account for 93,000 metric tons, followed by Jonagold at 52,000 metric tons, Kanzi at 15,000 metric tons, and Rode Boskoop at 11,000 metric tons. Conference pears are forecast at 260,000 metric tons, followed by Beurré Alexander Lucas, Xenia, and Doyenné du Comice varieties in smaller volumes. Rising input costs and stricter plant health regulations remain challenges for the sector.

Organic production is limited, with organic apples representing about four percent of total production (9,000 metric tons) and organic pears about two percent (7,000 metric tons). Organic cultivation faces pressure from pests, diseases, weather variability, and quality issues. Retail prices for organic fruit are generally about 50 percent higher than for conventional produce.

Apple and pear consumption in the Netherlands has declined over the past decade, with consumers shifting towards exotic or premium fruits such as berries, mango, pineapple, and melon. Apples remain the second most consumed fruit after bananas, while pears rank tenth. About 20 percent of the population eats an apple daily compared to five percent for pears. Most consumption occurs at home or work, with supermarkets, specialty stores, and markets as primary purchase points.

About 85–90 percent of Dutch apples are sold domestically, with Elstar and Jonagold as leading varieties. Pink Lady, mostly imported from France and Italy, is the most popular imported apple. Pears are a major export item, with around 15 percent of production shipped outside the EU to markets such as the UK, Norway, and Belarus.

Retailers are promoting club varieties like Pink Lady, Kanzi, and Morgana, as well as in-house premium brands such as Albert Heijn's Sprank and Jumbo's Tessa. The sector's long-term outlook will depend on profitability, regulatory changes, and generational succession.

To view the full report, click here.

For more information:

For more information:

USDA

Tel: +1 (202) 720-2791

Email: [email protected]

www.fas.usda.gov