Omer-Decugis & Cie, a global company in fresh and exotic fruits and vegetables, announced its financial results for the first half (H1) and third quarter (Q3) of the 2024/25 fiscal year. The results were approved by the Board of Directors on 18 July, with the full H1 report to be released by 31 July.

Chairman and CEO Vincent Omer-Decugis noted strong performance across all business segments, aligned with the Group's 2020–2025 strategic plan. He highlighted ongoing investments, including a major ripening platform, and new initiatives to define the Group's societal contribution under the CSRD regulatory framework.

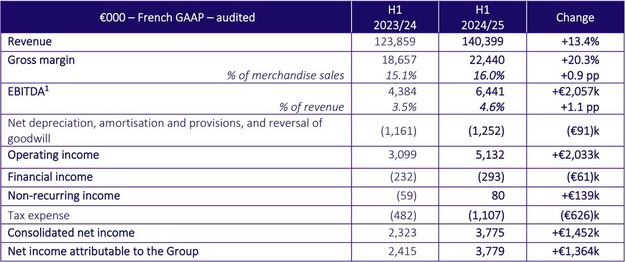

H1 Performance (1 Oct 2024 – 31 Mar 2025)

The Group achieved revenue of €140.4 million in H1, a 13.4% increase year-on-year. The SIIM division led growth, generating €111 million in revenue (+19.4%, with 15.4% organic growth), driven by gains in exotic and ethnic product ranges and synergies with EMA's operations in Northern Europe.

The BRATIGNY division posted revenue of €29.4 million, a 4.8% decline, attributed to weaker wholesale market conditions and a shift in consumer preference toward large-scale retail. The division is currently restructuring its product offering following recent acquisitions.

Gross margin rose 20.3% to €22.4 million (16.0% margin), while EBITDA improved to €6.4 million (4.6% margin), up €2.1 million from the previous year. Operating income increased to €5.1 million after depreciation and provisions of €1.3 million. Net income reached €3.8 million, up €1.4 million year-on-year.

Operating cash flow stood at €6.2 million, with a €6.3 million increase in working capital requirements due to inventory buildup. Investment outflows totaled €1.3 million. The Group reduced debt by €0.7 million, holding €1.8 million in cash and €5.2 million in gross financial debt as of 31 March. No bank credit facilities were drawn.

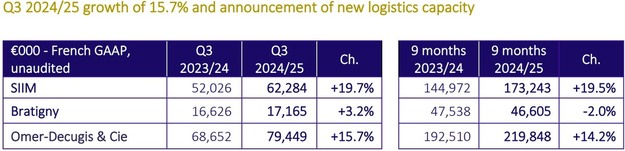

Q3 Performance (1 Apr – 30 Jun 2025)

The Group continued its growth in Q3, posting revenue of €79.4 million (+15.7% organic growth). SIIM led again with €62.3 million in revenue (+19.7%), bolstered by expansion in avocados, exotic produce, and innovative packaging formats. The wholesale division rebounded with €17.2 million in revenue (+3.2%), aided by increased consumer traffic at open-air markets and improved operational efficiency.

During the quarter, the Group announced a 30,000-tonne (+21%) expansion in ripening capacity via new developments in Sorgues and Rungis, ahead of the 2027 launch of its Dunkirk platform.

Nine-Month Overview

For the first nine months of the fiscal year (October 2024–June 2025), total consolidated revenue reached €219.8 million, a 14.2% year-on-year increase (including 12.3% organic growth).

To view the full report, click here.

© Omer-DecugisFor more information:

© Omer-DecugisFor more information:

Emeline Pasquier

Omer-Decugis & Cie

Tel: +33 (0) 145 12 29 60

Email: [email protected]

www.omerdecugis.com