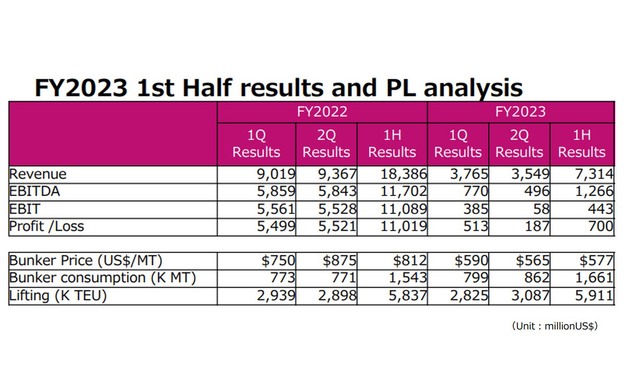

Despite the start of the peak season, there was no strong recovery in cargo movement. The supply-demand balance softened due to an increase of newly built vessels, and short-term freight rate levels did not sustain their upward trend. The profit after tax for FY2023 Q2 was US$187 million, significantly lower than the same period last year.

- In North America, cargo movement showed some momentum in August, but lacked sustainability against the backdrop of weak general consumption and other factors. In Europe, a gradual recovery trend from the decline in demand caused by high inflation was seen, however it did not lead to a full-fledged recovery in cargo movement.

- On East-West routes, tonnage increased due to the addition of newly built vessels, although blank sailings and service rationalization were implemented.

- The above factors softened the supply and demand balance, particularly on East-West routes resulting in stagnant freight levels.

FY2023 full year forecast

Full-year results for FY2023 are expected to show a profit after tax of US$ 851million, a decrease from the previous year, due to the deterioration of freight market caused by declining demand. (-US$ 14,146 million)

- Although it takes some time to see a solid recovery of cargo movements as high interest rates and inflation continues, a gradual recovery in the second half is expected.

- The oversupply of tonnage, caused by the delivery of a large number of newly built vessels in this fiscal year, is expected to continue through the second half.

- The freight market will remain weak in the second half due to the supply & demand gap described above, but ONE will focus on maximizing profit by flexible tonnage deployment and efficient equipment control based on demand.

Click here to read the full report.

For more information: one-line.com