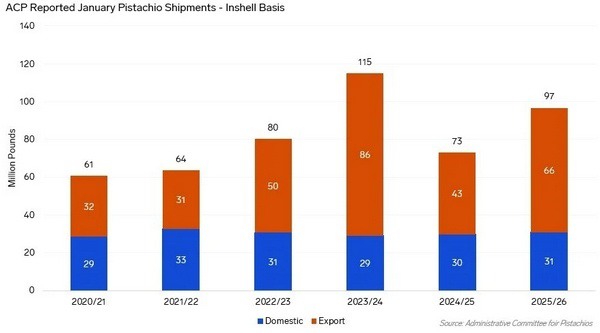

The Administrative Committee for Pistachios released its February 16, 2026, shipment report, covering the fifth month of the 2025/26 crop year. Pistachios follow a natural on-year and off-year cycle, with 2025/26 classified as an on-year. All figures are reported on an in-shell equivalent basis, with kernel weights converted using a 0.45 ratio.

January 2026 shipments totaled 96.7 million pounds, up 32.3% year on year and 23.2% above the five-year average. Export shipments rose 52.1% compared with January 2024/25, reaching 65.9 million pounds, while domestic shipments increased 3.4% to 30.8 million pounds. Compared with the prior on-year January 2023/24, total shipments were 15.8% lower.

© Mintec/Expana

© Mintec/Expana

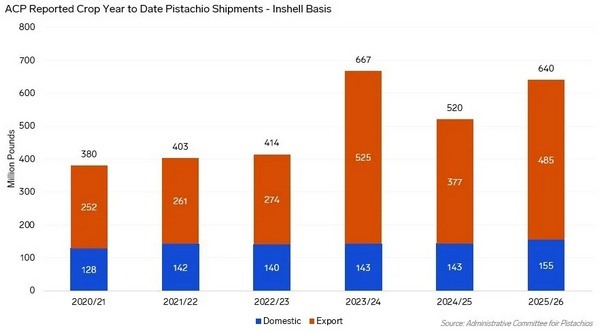

Crop year-to-date shipments from September through January reached 639.7 million pounds, up 23.0% versus the previous crop year and 34.1% above the five-year average. Export volumes increased 28.6% year on year to 485.0 million pounds, while domestic shipments rose 8.2% to 154.7 million pounds. Compared with the prior year 2023/24, total shipments remain 4.2% lower.

From a supply perspective, January receipts totaled 1.57 billion pounds in-shell equivalent, flat month on month and indicating that new crop inflows have largely concluded. Receipts were 41.6% above January 2024/25 and 5.3% higher than January 2023/24, the last on-year comparison.

Adjusted January inventory stood at approximately 1.517 billion pounds, up 0.3% month on month following routine shrinkage and shelling flows. Estimated marketable inventory ended January at 876.0 million pounds, down 9.5% month on month as shipments reduced available supply. Marketable inventory was 13.3% higher year on year and roughly unchanged compared with January 2023/24.

© Mintec/Expana

© Mintec/Expana

Market data show shipments running 23.0% above the prior year and 34.1% above five-year averages, although remaining 4.2% below the comparable on-year benchmark. Export markets are trailing the previous on-year pace by 7.6%, while domestic shipments exceed the prior on-year level by 8.5%.

Receipts reflect high production, while inventory drawdowns continue as shipment activity progresses. Participants report a steady to firm pricing trend supported by inventory movement and shipment levels that remain above historical averages, even as volumes trail the prior on-year record.

Source: Mintec/Expana