In recent years, high-end citrus varieties have continued to gain popularity in both domestic and international markets, with varieties such as Red Beauty and Yellow Beauty attracting particular attention.

Exports of this season's Red Beauty concluded in January. Manager Hong explained that frost in Jiangxi this year, combined with excessive rainfall early in the season, had a certain impact on fruit growth and acid reduction. As a result, the proportion of small and medium-sized fruit is about 20% higher than in previous years, although overall sweetness has actually improved.

Market competition has also intensified. "This year, a large number of counterfeit 'Red Beauty' products have appeared on the market. Some traders are using other, cheaper Ehime varieties to pass them off as Red Beauty, exporting them to Southeast Asia at low prices of around ¥20 per box, seriously disrupting market order," said Manager Hong. He added that so-called Red Beauty has even appeared on the market at ¥15–16 (US$0.10–0.11), putting pressure on the overall price system.

"Our sales have certainly been affected to some extent, but the company still maintains stable high-end customer channels, and some premium clients continue to insist on using genuine, high-quality Red Beauty," Manager Hong noted. From the perspective of variety development cycles, he believes that the period of high profitability for new fruit varieties typically lasts around five years. "Red Beauty became popular several years ago, and since last year, a large number of fruit traders have entered the market, significantly intensifying competition."

© Fresh Go Produce

© Fresh Go Produce

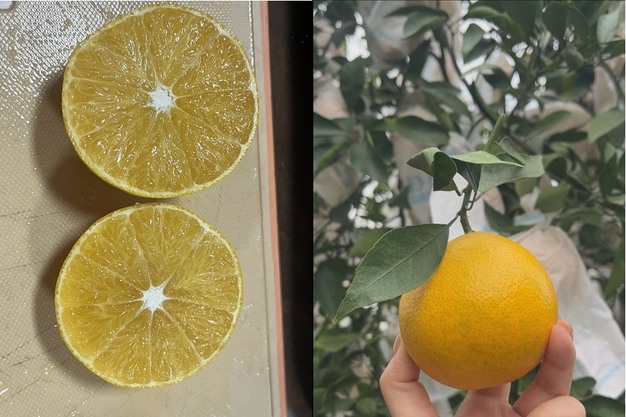

The Yellow Beauty variety is currently performing particularly well in the Singapore market. "Yellow Beauty has seen strong market performance this year, largely due to the later timing of the Chinese New Year," said Manager Hong. "In previous years, farm-gate prices were around ¥2.5, but this season they have risen to over ¥5."

Manager Hong pointed out that the later Chinese New Year created a transitional window between Red Beauty and other citrus varieties. At the same time, consumer concerns about the use of sweeteners in varieties such as Sumo mandarins and Chunjian oranges have become more pronounced, including in overseas markets. "Yellow Beauty has a sweetness level of 15–16° Brix, and its peel is extremely thin, making it almost impossible to use sweeteners—otherwise the fruit would easily rot. This gives traders confidence in food safety and has, to some extent, boosted demand for both Red Beauty and Yellow Beauty."

Manager Hong added that Yellow Beauty sales are currently strong, with prices slightly higher than those of Red Beauty. Finished products are selling at approximately ¥19–21 per kilogram.

© Fresh Go Produce

© Fresh Go Produce

"The promotion of tangelos has been quite effective over the past two years, particularly in the European and American markets, with relatively stable sales in Canada," said Manager Hong. Finished products are competitively priced at approximately ¥17–18 (US$0.11–0.12) per 2.25 kg.

In addition to mandarins, Fresh Go also focuses on exporting a range of niche specialty fruits, including fresh waxberries, niche lychees, pepino melons, and jujubes, with the goal of supplying overseas markets with more high-end Chinese specialty fruits.

© Fresh Go Produce

© Fresh Go Produce