Brazil's orange crop yield for the 2025/26 season is expected to remain below average, according to Fundecitrus, which issued a further downward revision to its production forecast in December. The lower supply outlook comes despite a year-on-year increase in output, as the comparison is against a historically low 2024/25 season. At the same time, orange juice prices continue to decline amid weak consumer demand.

Fundecitrus reported that adverse weather conditions and disease pressure affected orange production in 2025. In its latest update, the association reduced its forecast for the São Paulo and West-Southwest Minas Gerais citrus belt, Brazil's main producing region, to 294.81 million boxes of 40.8 kilograms each. This represents a 3.9% reduction from the September estimate, which itself had been lowered by 2.5% compared with the initial forecast released in May.

While total production is projected to rise compared with the previous season, Fundecitrus noted that volumes remain constrained. The increase follows an unusually low production level in 2024/25, limiting any broader recovery in supply.

© Mintec/Expana

© Mintec/Expana

Despite the tighter crop outlook, industry sources report that orange juice inventories are currently adequate. Market participants indicate that the sector is dealing with ongoing weak demand, which continues to influence pricing dynamics.

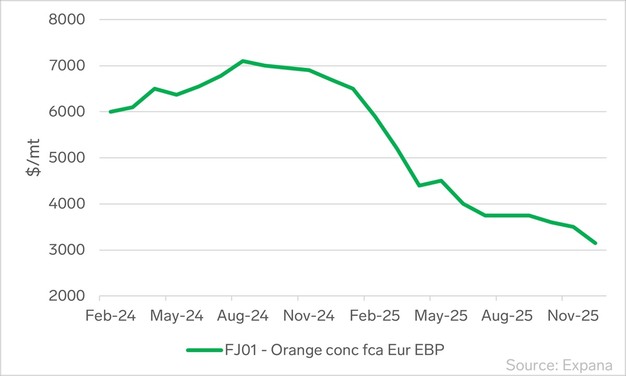

After a period of limited supply in 2024, orange juice prices climbed and reached a peak in August of that year. Higher retail prices led consumers to reduce purchases or switch to alternative beverages. Since then, prices for orange concentrate have declined, a trend that persisted throughout 2025. Sources report that consumer interest has not yet recovered, with retailers responding through promotions and discounted pricing.

Market participants told Expana that buying interest remained very limited in December. One source said, "Customers are still in hibernation." Demand from Europe has been described as weaker than anticipated, adding further pressure on prices.

Some participants are monitoring the market for signs of renewed demand, with cautious expectations of increased interest from the U.S. However, most have adopted a wait-and-see approach, given the current balance between supply, inventories, and consumption.

Against this backdrop, Expana Benchmark Prices for orange concentrate FCA Europe [FJ01] were assessed at US$3,150 per metric ton in December. This level was down 10% month on month and 53% year on year, reflecting the continued retreat from the elevated price levels seen over the previous two seasons.

The combination of lower crop forecasts, sufficient inventories, and subdued demand continues to shape market conditions for Brazil's orange juice sector as the 2025/26 season approaches.

Source: Mintec/Expana