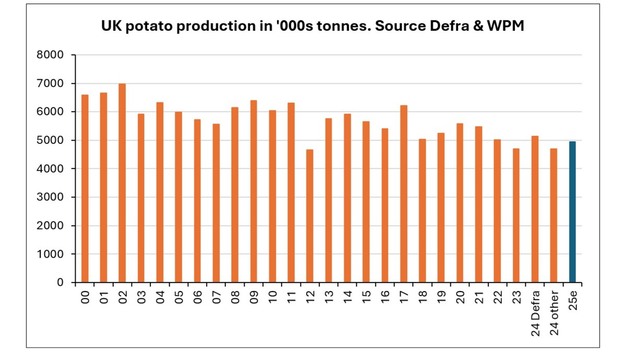

World Potato Markets estimates the 2025 UK potato crop at 4.9 million tons. This would be 300,000 tons below Defra's figure for 2024, although industry sources suggest last year's true output was closer to 4.7 million tons. Current volume appears adequate for market needs, despite this being only the sixth UK crop under five million tons on record.

A dry, straightforward planting season allowed crops to establish deep root systems, supported by irrigation in many areas and limited blight pressure. Attention now shifts to maintaining quality in the store.

© GB Potatoes

© GB Potatoes

EU potato production is estimated at more than 53.0 million tons, up 5% from 2024 and the largest crop since 2017. The combined output of Germany, France, the Netherlands, and Belgium is nearly 35 million tons, the highest recorded. France's crop is approaching 10 million tons, up 40% compared to ten years ago.

Large European surpluses and pressure on EU frozen chip exports from China, India, and Egypt have pushed processing potato prices sharply lower. EU free-buy prices, which reached €300/ton last season and were twice that level in 2023/24, are now around €15/ton. Long-term contracts will shield many growers from these low spot prices.

In the UK, free-buy prices have fallen but remain above EU levels. Potato Call reports whites selling from £100/ton, compared with £280/ton a year earlier.

Trade volumes remain subdued. Ware imports and exports have been low in the early months of the 2025/26 season. Imports of frozen fries appear to have peaked, with third-quarter arrivals at 204,000 tons, down 5% year-on-year.

© GB PotatoesFor more information:

© GB PotatoesFor more information:

GB Potatoes

Tel: +44 (0) 1507 353774

Email: [email protected]

www.gb-potatoes.co.uk