The current Peruvian avocado season has been marked by a later start than last year, high export volumes, and a rebound in prices after weeks of significant pressure. Europe remains the primary destination, but Peruvian exporters are working to strengthen their presence in Asia and adapt to new logistical, phytosanitary, and certification requirements.

© Grupo Juan Ruiz

© Grupo Juan Ruiz

José María Pascual, CEO of Grupo Juan Ruiz, stated that the company anticipates closing the 2025 season with 80 containers of avocados, 70 of mangoes, and 10 of mandarins. "The avocado season started later than last year due to dry matter levels. In addition, the harvest in the highlands coincided with that of the ravines, which generated volume peaks from week 13-14 onward," Pascual said. For several weeks, Europe absorbed more than 800 containers per week. However, the reduction in recent weeks has allowed prices to start recovering rapidly.

© Grupo Juan Ruiz

© Grupo Juan Ruiz

Currently, 80% of Grupo Juan Ruiz's shipments go to Spain and the Netherlands. The company predicts that Asia will shift from an emerging market to accounting for 30% of its exports. With existing clients in China and negotiations close to completion in Japan, the focus in Asia is on avocados. We will be at Asia Fruit Logistica, in Hall 3, stand 3G01, because Asia is vital for our export future," Pascual emphasized.

© Grupo Juan Ruiz

© Grupo Juan Ruiz

Pascual observed that, despite an estimated 25-30% increase in Peruvian avocado production, the European market has maintained prices through supermarket promotions that encouraged product rotation. However, between late July and early August, prices dropped by as much as 5 euros per box before rebounding.

Competition in Europe includes Spain, Morocco, Kenya, and Colombia, but the acceptance of Peruvian avocado remains high. Regarding mangoes, the recent 30% tariff imposed by the United States on Brazil could lead to increased volumes being shipped to Europe, potentially raising the risk of market saturation.

First mandarin shipments to China and logistical costs

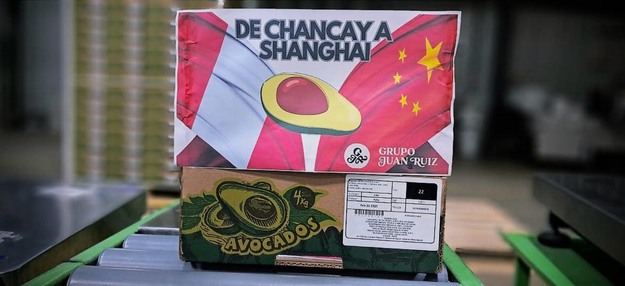

This season, Grupo Juan Ruiz became the first Peruvian company to ship mandarins to China through the port of Chancay, mainly of Satsuma and W. Murcott varieties. "The results were better than expected; the fruit arrived in excellent condition and with a favorable market situation," Pascual stated.

© Grupo Juan Ruiz

© Grupo Juan Ruiz

Regarding logistics, Pascual mentioned that freight costs have stayed competitive, especially to China. "The port of Chancay offers competitive rates and shorter transit times, making Asia even more appealing," he explained.

The Asian market demands specific standards and perfect presentation, which require strict control at each step of the supply chain. Meanwhile, Europe continues to increase certification requirements each year, encompassing sustainability, traceability, and waste limits. This means we must continuously update and improve our processes, he concluded.

© Grupo Juan RuizFor more information:

© Grupo Juan RuizFor more information:

José María Pascual

Grupo Juan Ruiz

Tel.: +51 967 964 189

Email: [email protected]

www.jruizgrupo.com