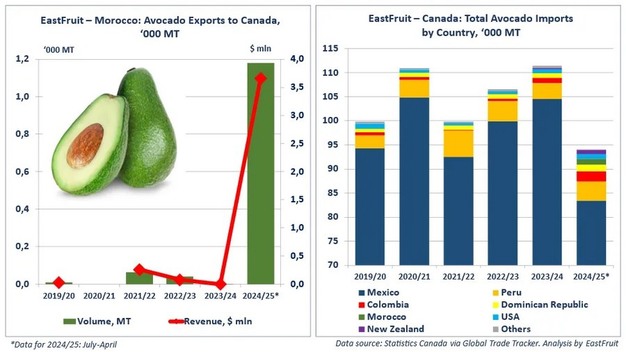

Morocco continues to expand its avocado export portfolio, reaching a record volume in shipments to Canada this season, according to EastFruit. Citing Global Trade Tracker data from Statistics Canada, Moroccan avocado exports to Canada during the first 10 months of MY 2024/25 (July–June) reached 1,180 tons, valued at $3.7 million. Given that previous exports to Canada had never exceeded 70 tons per season, this marks a significant milestone.

Canada represents a new and promising market for Moroccan avocados. Shipments this season took place between December and March, peaking in January and February, when monthly volumes exceeded 400 tons. Mexico remains Canada's dominant avocado supplier, accounting for more than 93% of total imports. Mexican shipments typically range from 6,000 to 9,000 tons per month, with peaks during the winter. However, two key challenges affected Mexico's avocado exports this season.

First, excessive rainfall in the summer of 2024 reduced avocado yields and negatively impacted fruit quality and size. According to market sources cited in the FAO's Major Tropical Fruits Market Review, Mexico's avocado production declined by 20% between January and August 2024. Second, geopolitical uncertainty played a role. Since many Mexican avocados bound for Canada transit through the U.S., threats from President Trump in early 2025 to impose a 25% import duty on Mexican goods created tension. Although the tariffs were not implemented, the heightened customs scrutiny and fear of delays may have caused Canadian importers to scale back orders.

As a result, Mexico's avocado exports to Canada fell. Between December and March, Mexico shipped 2,500 tons less than during the same period the year before. This shortfall opened the door for alternative suppliers, including Morocco. In January 2025, Morocco became Canada's second-largest avocado supplier with 409 tons exported. In February and March, it ranked just behind Mexico and Colombia, shipping 436 and 313 tons, respectively. These volumes helped cover nearly half of the seasonal supply gap.

Morocco's success in Canada highlights its strategic efforts to diversify its export destinations and strengthen its global presence. This achievement underscores the adaptability of Moroccan exporters, who seized the opportunity created by shifting international trade conditions.

Source: EastFruit