Rabobank released its North American Agribusiness Review, addressing many elements of the region's agricultural sector.

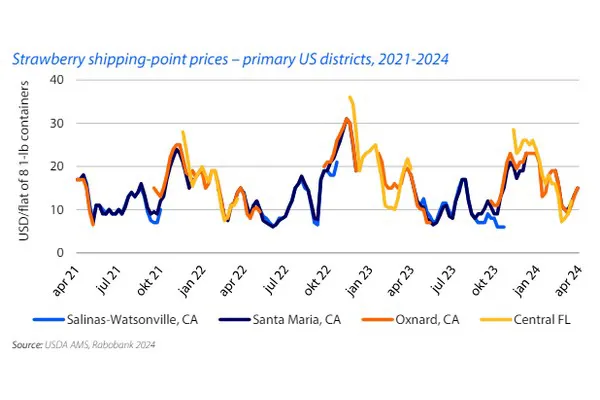

Strawberry shipping-point prices are around USD 15 per flat for non-organic fruit (down 17% YOY for product from California) by mid-April. Shipments are ahead of last year's. Strong availability is expected during the rest of the spring. With harvest ramping up in Florida, and favorable prospects for US production this season, fresh blueberry prices are entering the spring shoulder of the season.

Shipping-point prices for conventionally-grown fruit were close to USD 4 per pound, up 3% YOY. The organic price premium sits just over 40% by mid-April. Demand for berries is expected to continue strong this summer. Lemon shipping-point prices -140s- were just over USD 31 per carton, up 2% YOY, surpassing the five-year average for mid-April by 9%.

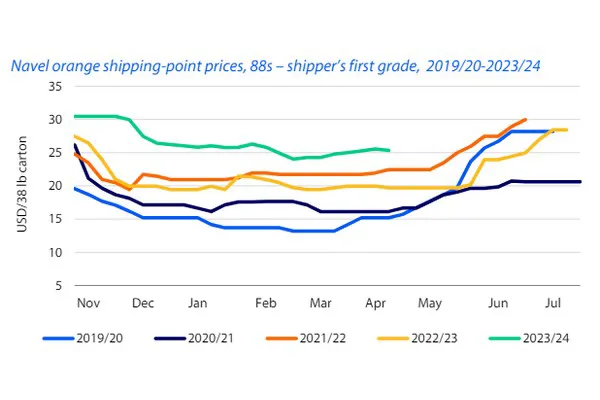

The California lemon crop will decline in 2023/24 to 22m boxes, down 15% YOY, per USDA estimates. Navel orange production in California is estimated to reach 38m boxes, up 5% YOY in 2023/24. Despite a larger crop, Navel orange shipping-point prices -88s- were around USD 25 per carton, up 28% YOY, by mid-April. California Valencia orange production in 2024 is forecast to reach 8m boxes, down 7% YOY, while Florida Valencia orange crop will rebound 24% YOY to 12m boxes.

Avocado availability in the US has been steady overall. Shipping-point prices for 48s are around USD 50 per carton, up 40% YOY, by mid-April. California crop is expected to be down 12% YOY, while shipments from Peru will also be down YOY. Prices are likely to increase this summer.

Downward pressure on apple prices continues as availability is significantly improved after the 2023 harvest. By mid-April, shipping-point prices of non-organic Honeycrisp, Red Delicious, Granny Smith, Fuji, and Gala were down 50%, 36%, 25%, 24%, and 22% YOY, respectively. US fresh apple holdings on April 1, 2024, totaled 68m bushels, up 36% YOY and 29% higher than the April five-year average. Honeycrisp inventory is up 97% YOY, per industry figures.

Click here to read the full report.

Source: raboag.com