Chilean clementines flood US market

The heaviest Chilean clementine loadings have been in Week 22 onward and that fruit will have just started to arrive at its destination in Week 25 although some vessels have been delayed owing to traffic tie-ups at the Panama Canal. The first South African bulk citrus vessel is expected to be available on the east coast early next week and it will add its cargo of clementines (and navel oranges) to the east coast’s summer citrus offerings. The last of the Peruvian clementines will also be arriving next week. There should be no doubt that as far as easy-peelers go, the US market is now in full-swing.

Through Week 25, clementines on the east coast have been selling at US$ 32-36

(mostly US$ 34) for standard sizes in the value-added, fixed weight packages. With

the increased volume of clementine arrivals erasing any residual perception of scarcity in the market, size 5’s are getting US$ 30 in the value-added package and size 6’s are a struggle to move.

The increased Chilean arrival volumes and the addition of the South African clementines to the volume of product available for sale will almost certainly result in a price shift in the market from Week 26 onward. Most contract prices are also set to decline next week. We expect to see clementines from Chile and South Africa move down a notch to US$ 28-30 and soon thereafter settle in to the US$ 26-28 price for the value-added package. To try to demand more as California table grapes and other summer fruits become more widely available could be a futile exercise. The mission must be to continue to move fruit at prices that will allow summer citrus to remain competitive and well-represented amidst the veritable cornucopia of domestic offerings now in the market.

Navel Oranges

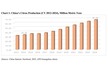

Through Week 24, Chilean exporters have shipped almost 1,000 metric tons of navel

oranges to the east coast or more than twice the volume shipped through the same

week last season. Over that same period, 122 metric tons have been shipped to the

west coast, a number also well ahead of last season`s loadings of 84 metric tons

through the same week. The first Chilean navel orange arrivals on the east coast will

coincide with next week’s arrival of the first bulk vessel of South African navels.

The opening of the navel season on the east coast is expected to be better than last season – not so much that prices will be higher, but that movement will be faster and inventories should not get backed up as they have in prior seasons when California oranges have remained readily available through the first two weeks of July.

We expect to see navel orange prices open up next week at US$ 30 on 40’s, 48’s and 56’s, US$ 28 on 64’s, US$ 26 on 72’s and 88’s.

While the rain that has been falling in Chile is welcome after years of drought, it has

made the picking and packing of the earliest navels a start and stop exercise. But the rain has also served to bring down the fruit’s acidity levels. This is allowing Chilean producers to pack fruit with good sugar:acid ratios in the earliest weeks of the season and will also help prevent delays on loading later on when navel oranges will be subject to USDA / AMS navel orange marketing order constraints.