The lemon market continues to see very high prices and imported fruit is barely able to satisfy demand. With the offshore season ending in a few weeks, it seems the only relief for the market will come once California's next district enters production. In Argentina, producers are preparing for their final shipments for the year.

"The South American season for fresh lemons is ending," noted Mariano Sangronis of Citromax. "Argentina's last loadings were expected during week 35 for the US market and extending to week 36 for other markets. Northern hemisphere lemon production is expected to begin after week 38, so the last arrivals from the Southern hemisphere will have a smooth sale transition since there is reduced stock in the market."

Weather conditions delayed start of Argentine crop

Argentina's lemon producers were unable to get the start they wanted this year, with weather conditions delaying the start of picking. Although numbers to the US were modest, growers say volumes will be up this season and they reported that consumers were receptive to Argentine citrus.

"Overall volumes will be up from last season," Sangronis announced. "We experienced poor weather conditions at the beginning of the season that affected picking. Argentine lemons were able to fulfill US customers’ expectations. We had the commitment to offer the high quality fresh lemon they remember from 2001 and we did so. Argentine fresh lemons are appreciated worldwide by customers, because they are extremely juicy, and have an excellent aroma and shelf life."

Strict regulations hampering efforts

The higher prices can be attributed partly to what growers say are strict regulations and limitations on production. They believe that certain regulations are unnecessary and only hamper production, leading to higher prices. "The extremely tough and limited agreement results in US customers paying exorbitant prices for both imported and domestic production," Sangronis explained. "Limitations make operators struggle to achieve the desired results, generating higher costs and limiting volumes to US consumers as happened during this summer. Argentine exporters stayed outside the US Market and prices in the US rose to a record breaking US$50 per box."

Sangronis suggested ways in which regulations could be looked at again and perhaps modified in order to increase production and thereby lower costs.

"The APHIS rule needs to have two major issues reworked and hopefully made more realistic, so that both Argentine suppliers and US customers can be satisfied with fresh lemons all year round at reasonable prices," he said.

"The two major limitations are:

- "1- Harvesting color limitation - Fruit must be collected while still in the green color scale. This color grade puts artificial limitations on Argentine growers who are unable to pick, classify, pack and sell a premium or fancy fresh lemon."

- "2- Packing House limitation - Packing houses are banned from working fruit destined for the US and other markets - such as the EU - at the same time. Being unable to pack lemons for different markets side-by-side creates logistical headaches both in the packing house and eventual marketing of the product."

Season considered a success

Despite the challenges of the first year returning to the US market, Argentine growers are pleased with how the season went. They said that being given the opportunity to demonstrate the professionalism of their industry will continue to guide them well. For the US market in particular, producers will seek to make sure there are no thoughts of competition with domestic supply, rather having offshore fruit as a good quality alternative for when domestic production is off its peak.

"The most important highlight is the highly professional work committed from growers, packing houses, exporters, Argentine Senasa and APHIS/USDA," Sangronis shared. "The Argentine lemon industry demonstrated that it is one of the most prepared and professional sectors in the world. It was important this season to show that Argentine lemons do not compete with US domestic production and instead complements the summer gap for US customers. We should continue to work on this scope."

"It was also important to show that Argentina can supply markets that demand high quality," he continued. "Argentina continues to consolidate EU, UK and Russian markets and new agreements are coming for next season."

Continued growth expected

Citromax said it will continue to seek growth opportunities where they may be found and noted their focus for the US market. As the lemon season winds down, the company will begin to focus on their next commodity for the year - blueberries.

"Citromax is consolidated as the third largest lemon processor in the world," Sangronis observed. "It’s also the largest organic lemon grower and processor worldwide. We continue to expand our fresh business around the world and as a US-based company we will continue to grow together with our US customers."

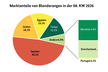

"Next month we will be starting our blueberry season," he added. "Citromax will supply the US market with high quality blues, conventional and organic, during the upcoming months."

For more information:

Mariano Sangronis

Citromax

Tel: +1 (570) 242-0131