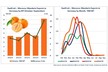

"When there is high demand and prices go up it is not good for us," explains Rob Cullum from UK importer Pacific Produce. "Peaks in demand don't help anybody. At £10 a box you would think everyone would be happy, but somewhere someone is losing money to support that price. The retail lime prices in the UK don’t change very much year round, so spikes in market prices do not reflect the retail price on the shelf."

According to Rob, limes are a very difficult product, very up and down and very difficult to predict what is going to happen. "At the moment Mexico does not have as much as it should and Brazil is coming into a new crop off the back of a six month period of low to average quality and understandably they are asking for price increases.

When the fruit was arriving in bad quality they were getting hit by claims so they are now seeing the market rise and have good quality fruit and can ask the high prices for it. This is in combination with Mexico shipping less and a good US market which is the easy alternative.

There are other countries exporting but they don't have enough to cover when the major producers are down. "We have a great operation in Guatemala which has advanced in both availability and quality in the last few years for example, but of course any new supply country will often have the same kind of issues of supply and demand as the big 2 (Brazil and Mexico)," explains Rob.

"When prices are like this people come out of the woodwork and make the situation worse, also traders in the source countries are scrambling around to get fruit, these are people who don't usually handle this fruit and may not have the technical standards. So then fruit is shipped which is not of the required quality and someone gets left holding the mess, then the whole market will crash and that is when people get really hurt."

Lime prices can really hit the extremes, sometimes £1 pound a box, sometimes £10, that is just how it is explains Rob. "It is difficult to predict and you can't store the fruit so you can't have a contingency."

Peru is not a world player in the lime game, they can produce for 12 months but the volume sent to Europe is just a drop in the ocean compared to countries like Brazil, the total export of Peru in an entire year would equate to just one week of export from Brazil..... Peru does produce huge volumes of the Sutil limes used for Ceviche but these are small, seeded, with high acid and a low shelf life so not suitable for Europe. Peru does ship some Tahiti, at the moment this export is in its infancy with sporadic volumes. One of the larger receivers is Chile – with a short journey time and a higher tolerance for pale fruit.

Rob predicts a shortage for at least another 4/5 weeks, but after three weeks of high prices, consumption will drop soon, the good weather could support volumes for a while longer but it will eventually drop.

"People will replace limes for lemons where possible, caterers will, for example, only use lime in the mojitos but not in the G&Ts or cokes.

Lemons are no where near the price they were this time last year due to bigger volumes from the northern hemisphere and extensive planting in South Africa. When you consider lemons are not far from the price of limes, and it is a 15 kg carton, while limes are in a 4kg carton, you can see why people will switch to lemons where possible!

The price of lemons in the UK is approximately £10 per carton cheaper than last year – in the past when a very high lemon price coincided with a lime shortage, it meant no real choice for the consumer, but today the lemon option is a bit easier.

For more information:

For more information:Robert Cullum

Pacific Produce

+44 (0) 1865877801

Email: [email protected]

www.pacificproduce.co.uk