Trend to Far East

“If you look at the statistics, then you see that most of our trade is still very much focused on Europe,” said Gary Britz of Ele Trading. “But more product is going to the Far East, and I think that trend will continue.” China grows some of the the same products that South Africa specializes in, but though that might make it difficult to find a market for apples, for instance, it's easier to find gaps in the market for items like grapes, which can't be stored for long periods of time and which aren't currently grown throughout the year in China. But any expansion into Asian countries, or any shift in the industry, for that matter, is still dependent on a myriad of factors that are almost impossible to coherently interpret.

“These things depend on the exchange rate, phytosanitary regulations, the purchasing power of consumers, consumer demographics – because older people buy differently from younger people – and the growth of retail chains versus wholesale markets,” Gary noted. “Right now, Africa is not buying much because their oil industry is in shambles due to low oil prices, but if prices go back up, then more product will be diverted to those markets. A lot of people say they can anticipate these things, but every day is different.”

Filling gaps in market

Rather than peering into a crystal ball, Gary noted that shippers, for the most part, seek gaps in foreign markets and round up product to make good returns in those markets.

“South Africa competes with Australia, Chile, Peru, Brazil and New Zealand,” he explained. “It's about looking for marketing gaps left by other countries and seeing what products we can grow here to match those. For instance, can we get apples into the market before New Zealand? That's what we have to look at.”

Production areas up, growers down

At home, the main items grown remain the same, but the business of growing them and who grows them is still in flux. Production areas keep increasing, but those areas are handled by fewer growers. The same big categories still dominate, but the particular varieties grown within those categories are being updated regularly to meet evolving consumer tastes.

“A lot of growers are now marketers, and if they're not then they interact closely with marketers to decide what to grow,” explained Gary. “The table grape industry, for example, is developing great new cultivars. There's a lot of replacement plantings with stuff like Sweet Celebration, where growers are looking for something with better production, has great marketing potential and is labor friendly.” With new varieties that possess better yields, he thinks the industry can boost annual production up to 60 million cartons.

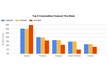

But where those cartons will go and what will be in them is yet to be determined. Crimsons and Autumn Royals, for instance, do better in Asia than in Europe. So if trade shifts more to the East, then one could assume more production will be dedicated to those varieties. Thompsons, on the other hand, are very popular in Europe, so they would have a bigger presence if the majority of trade remains with Europe.

Growth in navel

With citrus, Gary pointed to late Navels as a growth item. Especially with new varieties that have better flavors, consumers are flocking to late Navels. That's reflected in the amount of acreage dedicated to that item. With Valencias, the country's drought is likely to affect the composition of the fruit as well as the size. Those Valencias are very popular in China, especially the Midnights and Deltas, so, like with new Navels, more acreage is expected for Valencias. Satsumas and mandarins, on the other hand, are likely to see decreased production, even if some of the new varieties are doing well.

Apple market performs well

New Fuji apple plantings and Royal Gold apples are doing well, especially in Europe. In Asia, Granny Smiths are still received well, and Royal Galas continue to be shipped worldwide. With pears, Canada takes Boscs and Asia prefers Packhams. As is increasingly the trend across the agricultural sector, top fruit in South Africa is mostly grown and shipped by a few large growers. Despite this, for a shipper like Ele, which just celebrated its second anniversary of its founding, small growers can still find a place in the export market.

“It's about keeping good relationships,” noted Gary. “We're a small team and it's an extremely competitive business, but when you do things well and you pay your suppliers well, you keep those suppliers and grow quite quickly.” The company receives its citrus, which makes up half of its shipments, from just seven growers and it makes up the rest from fellow traders. It ships to Europe, the U.K. and the Middle East, but it has enjoyed special success in Asia with its Ele brand.

“Though its hard to sell grapes in Thailand because of the taxes to ship there, we do well with citrus,” he said. “Our name brand recognition in Asia is very good.”

For more information:

Gary Britz

Ele Trading

Tel: +27 21 976 0604

Email: [email protected]

www.eletrading.co.za