Claire begins with an uncertain start to the mango season, because of the El Niño that was taking place. “So far up to this week there is no harsh El Niño like everyone was expecting in Peru, but with all the incidents going on in Ecuador and some other areas in South America this should not be a reason to forget about it. With this being said, this was a factor for many shippers and producers in the Peruvian mango season to start harvesting sooner than was expected and hence we see mangos from Peru in the earlier stage.

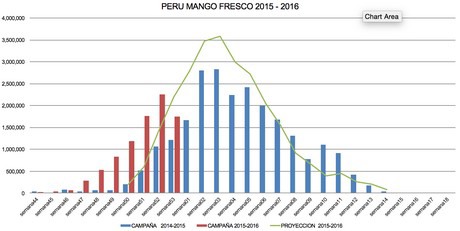

Source: APEM (Asociación deExportadores y Productores de Mango) en Peru.

Is the season going as expected?

“APEM does a great job with their forecast in Peru in which if you see the green line above, the Peruvian mango season should have started on week 50 with very limited volumes. Volumes from Peru departed on 51/52 this year meaning we see a contrast in the spot market. But, since the season started earlier than expected having the fixed quantities spread out over the Peruvian season, this might either 1. End or reduce the available volumes sooner than expected, or 2. Be spread out evenly with limited volumes throughout the season. I believe, the first one is the case since at the moment many of the small growers are going into their second bloom set (segunda floración). In an orchard, going into the second bloom set it’s an indication of less volume already.”

What are the main markets and are you exporting to new markets?

“Peru as a whole has new opportunities with regards to the Korean and Asian markets. IQF markets is another option to market the Peruvian mangoes. With regards to Asica, we work with few key customers in the EU and US and we try to focus on them so we have a clear understanding from what their retailers and the end customer needs and we can adhere to those standards for each tailor made load.”

Are there competing countries and how do you deal with that?

“In the beginning of course there was Brazil who complicated things for the Peruvian mango. But as we move through the season Brazil is less of a threat. Brazil barely shipped 50 containers to the EU in week 53 ETD which also includes the non-fibreless mangos. I think the number one competition or threat for the Peruvian mango are the not so responsible spot traders that are not in line with their wholesale accounts and programs. For the next few years, we probably will see this going further down since retailers, fresh cut industry and the processing side are more interested in going directly to the source and not buying that much from brokers. Wholesalers hopefully will only take what they need for their accounts and hopefully this will be a good solution to stabilize supply vs demand. Also, demand for ready to eat mangoes and ripen mangoes sold in the retailers are increasing in which the consumer wants to eat their mango and consequently other products such as avocados the same day, and not buy it and wait several days before they can taste and enjoy it. This also could increase the demand since consumers can buy the product the same day, eat it the same day or next day, and buy again shortly after. This needs a lot of attention in quality and after ripening testing in the orchards at the source. The US market in the future might also adopt this since the US model is the “hard rock” fruit but it might change in the next few years. Consumers also want to know where their products are sourced and have a better understanding of where their food is coming from, do they follow up good agriculture practices? Do they treat their work force correctly under the local norm? Are they socially responsible? Do they minimize the resource consumption and minimize Carbon footprint? At Asica we try to think of these things which might be hard at the beginning, but we are looking forward to finding solutions and implementing strategies to be eco-friendlier while we adhere to all the norms and standards.”

How is the demand for Kent mangoes? Do you notice a switch to other varieties?

“Fibreless mangoes are becoming more and more popular throughout the world. Sure, there are some local Peruvian varieties but it would be near impossible to export the variety and it is full of fiber. With the taste, texture, shipping conditions, and size, Kent would be the King of the mangoes and Asica specializes in the production of this variety.”

Claire concludes: “Asica is committed to not being just successful in the agro-industry in Peru and keep our customers satisfied, but also provides a helping hand to the ones that need that in our area. For instance, Tambo Grande lacks hospitals or urgent carers and nursery homes. It is our aim and plan to have an “at cost” urgent care and nursery home to help our community in the short term throughout our social outreach unit.”

For more information:

For more information: Claire Joosten

Asica Farms SAC

Piura - Perú

E: [email protected]

www.asicanatural.com