Domestic lemon production has recently started up while the previous year ended in July. California is the largest lemon growing state with 47,000 acres in production. The remaining 8,300 acres are grown in Arizona. During the 2014-2015 season, California’s lemon production increased 9 percent over the prior season. Arizona’s lemon production was up 11 percent during the 2014-2015 season. For the upcoming season, California production is expected to be stable while Arizona production is expected to be down between 15 and 20 percent.

Lemon acreage up

While oranges, grapefruit and tangelos show a decline in acreage, lemons and tangerines/mandarins were the only citrus varieties to show an increase. In 2014-2015, US lemon acreage amounted to 55,300, up 1,000 acres compared to the year before.

Lemon prices were strong throughout the 2014-2015 season. The beginning of that season had prices starting very strong due to a smaller 2013-2014 harvest. The season also ended on a strong note with the season-average price being 14 percent above the 2013-2014 season-average price.

Strong lemon prices resulted in an increase in production value, up from $641 million in 2013-2014 to $694 million in 2014-2015. Utilization for the fresh market however went down from 630,000 tons to 621,000 tons. This upcoming season, utilization levels are expected to increase again due to high quality of the crop.

Mexico key US lemon supplier

US lemon imports increased last year to a record 169.6 million pounds. This increase was triggered by lower fresh production and higher prices. Mexico provided 54 percent (equivalent to 92.1 million pounds) of all lemons imported into the US and the country has been increasing its lemon shipments to the US year over year. Chile is the number two sourcing country for lemons and exported 62.2 million pounds during last season, more than doubling the volume shipped the year before. Shipments from Spain almost tripled compared to the previous year and amounted to 10.3 million pounds.

Japan major destination US lemons

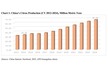

Lemon exports exceeded imports and amounted to 247.9 million pounds last year. Japan was the largest destination for US fresh lemons, buying 67.9 million pounds. Canada received about the same amount as Japan. South Korea ranks third, receiving 30.2 million pounds. Despite the strong export number, domestic per capita consumption increased 5 percent from the previous season. Since 2010, US per capita consumption of lemons has consistently been above 3 pounds per person.

The TPP agreement results in Vietnam eliminating its 25 percent tariff on lemons within three years. In Malaysia, tariffs on lemons will be eliminated immediately, increasing opportunities to grow US lemon exports in future.

Domestic lemon production has recently started up while the previous year ended in July. California is the largest lemon growing state with 47,000 acres in production. The remaining 8,300 acres are grown in Arizona. During the 2014-2015 season, California’s lemon production increased 9 percent over the prior season. Arizona’s lemon production was up 11 percent during the 2014-2015 season. For the upcoming season, California production is expected to be stable while Arizona production is expected to be down between 15 and 20 percent.

Domestic lemon production has recently started up while the previous year ended in July. California is the largest lemon growing state with 47,000 acres in production. The remaining 8,300 acres are grown in Arizona. During the 2014-2015 season, California’s lemon production increased 9 percent over the prior season. Arizona’s lemon production was up 11 percent during the 2014-2015 season. For the upcoming season, California production is expected to be stable while Arizona production is expected to be down between 15 and 20 percent.