Andrés Rodrìguez, president of the Chilean Walnut Commission, at Expo Milan.

Chile is the leading exporter of shelled nuts and the third exporter of whole nuts after US and France. Last year, the turnover was 850 billion dollars and this year it is expected to exceed one billion dollars.

What is more, the sector is expanding together with the markets of Italy, Turkey, Brazil, Germany and South Korea, i.e. the main importers.

The production

"Every year, 3 thousand new hectares of walnut trees are planted in Chile. This year we have reached 37 thousand hectares." There are two main varieties - the first is called Sirr and it is an early variety, because it is harvested in March, the second is the Chandler, which we harvest in April."

Walnut hectares in Chile between 2008 and 2015. Click here to enlarge (FreshPlaza processing of Chilean Walnut Commission data).

The direct consequence of this increase in hectares is a growth in production, which should be 33% more than 2014 reaching 65 thousand tons.

But that is not all, because like all the other fruit trees, walnuts also need some time - 4 years, to be precise - to start producing. Compared to other fruit trees though, they have a longer productive period of over 25 years.

"Our production should double over the next 5 years." As can be seen in the chart below, 31% of the hectares have not started producing and another 38% has not entered the full production stage.

Chart explaining how the 37,579 hectares are divided - those still not producing anything, those that still have to reach their apex, those at their apex and those with a diminished productivity. Click here to enlarge (FreshPlaza processing of Chilean Walnut Commission data).

But the increase of cultivated areas and production are not the only news. "In the past three years, we have also started shelling walnuts mechanically because we do not have enough workforce to do so by hand and because there are foreign markets that require the fruit to be shelled mechanically, such as for example Asia and even Europe. This is also one of the reasons why the Chandler variety is the most popular, as it is more suitable for this type of processing."

Exports

95% of the Chilean walnut production is exported. Turkey and Brazil are the main destination, though 64% of Exports are destined to Europe. Italy is among the leading importers - in 2014, it exported little less than 4 thousand tons, but the figure increased by over 2 thousand tons in a single year. "The increase in production has coincided with an increase in Italian demand."

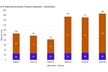

The export trend (in tons) towards the 5 main destinations. Imports towards South Korea only started in 2012. Before then, Spain occupied the fifth place. Click here to enlarge (FreshPlaza processing of Chilean Walnut Commission data).

Perspectives

Rodrìguez feels the walnut market will continue growing to "meet the demands of a growing global population and the increasing demand for healthy products such as walnuts. The fruit contains more antioxidants than blueberries as well as Omega 3 (which can help prevent diabetes, ictuses, heart and circulatory diseases), vitamins E and B and minerals (manganese, copper, potassium, calcium, iron, magnesium, zinc and selenium)."

Rodrìguez's presentation at Expo Milan.

In the short term though, the situation is "quite complex as, although they are still profitable, prices are decreasing due a currency devaluation in Europe, Russia and Brazil and an increased world population." In addition, production in the US and China has also increased.