Dutch fruit and vegetable export 2013: less kilos; more Euros

The export of fresh Dutch fruit and vegetables remained the same in 2013 according to KCB figures. The export of Dutch vegetables was a little larger, but significantly less Dutch vegetables were exported. It was the smallest fruit export in years (table 1a on page 6). There was an increase in value in both the import and the export in 2013. The value of the import increased by 7% and that of the export by 3%. The overall growth for fruit was +11% in import and +9% in export.

According to Eurostat 5 billion Euro worth of fruit and vegetables were imported last year. The export was worth 7.3 billion Euro. This is both Dutch product and re-export (table 1a).

70% of import from outside the EU; 85% of export goes to EU countries

According to Eurostat figures, almost two thirds of the import of fresh fruit and vegetables comes from countries outside the EU. In fresh fruit the share of non EU countries is three quarters. This is based on country of origin ("last port"). If the real country of origin was looked at, the non-EU share would likely be even bigger, for instance bananas that were imported through Belgium. The export of fresh fruit and vegetables is mainly focussed on EU countries, 85%. In import the importance of third countries has grown in the past years, whereas in export the ratio of EU to non-EU has stayed the same (table 1b).

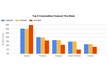

Two thirds of imports in Lithuania is from the Netherlands

Out of all the EU countries important to our export, the share of import of fresh vegetables from the Netherlands is largest in Lithuania, 66% in 2013. Their total import as well as that from the Netherlands has grown quickly. 30% of the import of fresh vegetables in Poland is from the Netherlands. In Belgium the share is over half and our main buyer, Germany, also has a share of over 40%. 30% of English vegetable import also comes from (through) the Netherlands. In the French vegetables import the Netherlands' share is a lot smaller, at 11%. The Spanish import is the same. In Italy the share is a little higher, 20% (table 16a).

The share of the Netherlands in the import of fresh fruit in the various EU countries is much smaller. But the Netherlands does have a 17% share in Germany's over 5 million tonnes fresh fruit import (incl. re-export; 886,000 tonnes, of which only 52,000 tonnes is Dutch product according to the KCB. In recent years the share in Germany has even grown (table 16b).

Spain is the Netherlands' main supplier: although more fruit than vegetables arrive, Spain is the largest supplier of fresh fruit and vegetables. Last year 17% came from this country, 37% vegetables and 10% fruit. In fruit, South Africa is the main supplier, with a share of 16%. This country has a subordinate role in the import of fresh vegetables, but overall South Africa is our second supplier. It is followed by Belgium (a lot of re-export of a.o. bananas), Costa Rica, Chile, Brazil and Germany.

The import of fresh vegetables from non EU countries grew steadily until 2012, but last year it was slightly less. It was a quarter of the total. Spain, Belgium, Germany and France are the main suppliers of fresh vegetables. Increase in the import from countries in the middle group can be seen in Egypt (mainly onions and some beans), Morocco (beans and tomatoes) and Peru (asparagus). What is striking is a large amount of smaller fresh vegetable suppliers with growth, such as Senegal (beans and tomatoes), Turkey (tomatoes and leek), Guatemala (pods), Zimbabwe (pods), the Dominican Republic and Tunisia.

More and more fresh fruit from South Africa

As previously mentioned, it is striking that more and more is being imported from South Africa. It was already at 575,000 tonnes in 2013. Over half of this is citrus, followed by grapes and apples (table 8). After a peak in 2010 the import of fresh fruit from Spain decreased to 350,000 tonnes in 2013 (table 7). The fruit import from Chile is now reasonably stable, after a dip. A clearly larger amount of apples were imported in 2013 compared to the previous years. The import of grapes, on the other hand, was smaller. Among the smaller products the steady growth of the import of cranberries stands out (table 9). Both fruit and vegetables are being imported from Peru more and more. This is not just the main product, mangos, but mainly avocados and grapes (table 10). Brazil is a reasonably constant supplier of fresh fruit. This certainly goes for the main products melons and mangos. The import of limes was stable in 2013 after a previously consistent growth. The import of Brazilian grapes is becoming increasingly smaller (table 11). After a dip in the import of Argentinian fruit in 2012 there was a slight recovery last year. This trend is mainly controlled by the import of oranges. Pears, on the other hand, are a growing product, as are watermelons (table 12).

Very wide export package: largest share 10% (oranges)

Oranges are the main import product, but their total share is only just 10%. There is still growth in the import, mainly from South Africa. Spain is a distant second, and Egypt is third. The import of oranges from Egypt is growing too (table 18). Bananas were the second import in 2013, but this is mainly due to more of this product being registered in the Netherlands than before. More export is also being registered. Third on the list is grapes. After a decrease in the previous years the import has been on the rise again since 2012. South Africa is the main supplier, followed by Chile. India is now the Netherlands' third grape supplier with an amount of 33,000 tonnes in 2013. The import from Peru is also growing steadily (table 19). Apples are the fourth import product. Last year a little more was imported than in both previous years, but not as much as prior to then. Chile is the main supplier at a distance (table 20). Pineapples are a real growing product. Almost 300,000 tonnes of it was imported in 2013. The pineapple mainly comes from Costa Rica (table 21).

The first vegetable product on the list is tomatoes. Spain is the main supplier at a distance (table 22). Grapefruit is second. The 180,000 tonnes import in 2013 was a record. South Africa is the main supplier, followed by China (table 23). The import of pears was slightly larger than before in 2013 with 164,000 tonnes, but amounts of 180,000 tonnes like in 2008/2009 will not be reached for the moment. ZHR countries South Africa, Chile and Argentina are most important (table 24).

A third goes to Germany

Germany is the largest buyer of both fresh fruit and fresh vegetables by far. According to Eurostat figures 2.2 million tonnes went to Germany in 2013, 1.2 million tonnes of fresh vegetables and 1 million tonnes of fresh fruit (table 13a). The export of exclusively Dutch products to Germany was 830,000 tonnes in 2013, 780,000 tonnes of vegetables and 52,000 tonnes of fresh fruit (table 13b). Tomatoes are the main product followed by cucumbers. There are also more and more bananas going to Germany through the Netherlands (on paper). The export of peppers to Germany was lower. Especially the re-export was lacking. A comparison between various sources (tables 13 a, b and c) shows that the registration of the export by the KCB is far behind that of other sources. Re-export can not explain this.

At almost 800,000 tonnes the United Kingdom is the second buyer. This amount is clearly smaller than in previous years. The large vegetable products are at the top of the list (table 14a). KCB gives an export to the UK of 430,000 tonnes (table 14b) for 2013. At 460,000 tonnes France is the third largest buyer. More fruit goes to France than vegetables. A large part of this is re-export of fresh fruit. The KCB registered an export of 26,000 tonnes of Dutch fruit last year: according to EUrostat figures 256,000 tonnes of fresh fruit went to France (tables 15 a and b).

Export: Growth in the re-export of products

The large vegetable producers dominate the list of export products. Onions and tomatoes are the largest, both with an export of over a million tonnes. Cucumber, peppers and carrots are the next three. They are followed by the fruit products: bananas, apples, pears, pineapples, oranges, grapefruit, avocados, melons, mangos and lemons. The growers are the re-export products: bananas, grapes, avocados and mangos (tables 37 to 51).

Import flow evenly distributed over the year; export peak in May

The flow of import of fresh fruit and vegetables to Holland is reasonably evenly distributed over the year. April and May are the most important months (a lot of ZHR fruit) with an import of almost 500,000 tonnes. The import is the smallest in the last months of the year, around 300,000 tonnes. The re-export is less evenly distributed over the year. May stands out with an amount of around 850,000 tonnes (in 2013). February and December only reach around half of this.

For more information:

Fruit & Vegetable Facts

Jan Kees Boon

+31 6 54 687 684

www.fruitandvegetablefacts.com

[email protected]