US: Chilean clementine loadings to USA begun

Through Week 31, clementines continue to sell at US$ 32-36 (mostly US$ 32-34) for

standard sizes in the value-added (bagged) configuration and US$ 28-30 for smaller

sizes. Over the next two weeks, we could see some softening of these prices as the

relatively heavy Week 28 and 29 departures hit the market. But with little fruit to

follow, any weakening should be short-lived and followed by an uptick in pricing toward the end of August as easy-peeler supplies dwindle before the onset of the W. Murcotts and other late varieties.

The late mandarin market should open up in Week 36 and, among exporters, there are expectations of a robust market. The freeze that struck some citrus growing regions in Chile in Week 29 (with more threatened) has taken a toll on the availability of late mandarins, but the extent of the damage has not been quantified. The preliminary opinion of the Chilean Citrus Committee is that 10-15% of navel oranges and mandarins may have been “compromised”. In the absence of any hard industry-wide data, many growers are sensing the increase in value of the remaining product. Exporters are competing in the fields for fruit and expectations among all stakeholders in the Chilean industry are high. These expectations are being passed on to the market. We expect to see the W. Murcott market open up at US$ 38 – 42 for value-added packages (10 x 3 lbs.). Many are betting that this price will persist through the entire season. In the end, that will depend on the ability of chain stores to consistently sell the available product at retail prices of US$ 7.99 – 8.99 for a 3 lbs. bag of fruit.

Navel Oranges:

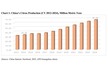

Navel oranges continue to enjoy a robust market characterized by good movement and healthy pricing. South Africa has so far this season, shipped 1.55 million cases of navel oranges to the east coast This is 15% more than was shipped over the same period last season. To date, South Africa has landed three bulk vessels on the east coast with a fourth expected to arrive and discharge by the end of Week 32. In spite of the increased loadings, there has been little inventory carryover from vessel to vessel and prices in the market are stable.

Through Week 30, Chile has loaded to the east coast almost 12 000 metric tonnes of

navel oranges (or 800 000 equivalent 15 kg cases), a decrease of 10% from last season.

Over the same period, 7 300 metric tonnes of navel oranges (or 486 700 equivalent 15 kg cases) have been loaded to the west coast, an increase of 8% over last season.

Navel orange prices for delivery through Week 31 are US$ 26 - 30 (mostly US$ 26-

28) for 40’s and 48’s, US$ 26 for 56’s and 64’s, US$ 22-24 (mostly US$ 24) for 72’s

and US$ 22–24 (mostly US$ 22) for 88’s. Prices on the west coast are running at the

higher end of the price range. Of course, there are programs with prices (fixed in the

pre-season) that are lower than today’s transactional market price. Sellers are making efforts to keep these programs minimally supplied until the market price comes closer to the fixed price.

South African navels will continue to arrive in the market with cargo from the next bulk vessel arrival expected to be available early in Week 32. As well, increasing volumes of Chilean navels will arrive from Week 32 onward which will keep the market well supplied.

The solid pricing that we have seen since the start of the season may start to

soften as inventory levels inch upward. But it is expected that navel pricing will remain stable for the next few weeks.

Weeks 31 and 32 should see heavy navel loadings leave Chile as these will be the last weeks of departure for fruit that hopes to arrive before the USDA/AMS Marketing order for Oranges comes into effect. But, with acid levels that are declining slowly, we could see Chilean navel loadings taper off in Week 33 and then resume (the following week) as maturity indexing safely allows more fruit to ship. The freeze that affected a number of navel orange producers will also have a moderating impact on loadings for the next week as growers and packers continue to monitor picked fruit to assess (prior to packing) the extent of any freeze damage.