Japan's citrus sector faces continuing structural decline driven by aging producers, labor shortages, and reduced orchard maintenance, resulting in lower mandarin and orange production in marketing year (MY) 2024/25 and a modest recovery expected for MY 2025/26. Weaker domestic mandarin supplies will temporarily increase the demand for imported citrus—especially U.S. oranges and grapefruit—although it will diminish as domestic production rebounds. Japanese consumer preferences tend toward domestically grown lemons and sour-type Japanese citrus varieties that may impact future demand patterns for imported lemons and limes. U.S. exporters remain well positioned because of established distribution channels and consistent product quality, though international competitors continue to influence seasonal imports.

Crop Area:

Japan's mandarin acreage continues to decline because of structural factors such as demographic pressure, labor shortages, and the high cost of maintaining aging, hillside orchards. Citrus production remains concentrated in the coastal prefectures of Wakayama, Ehime, Shizuoka, Kumamoto, and Nagasaki, where long-established orchard systems and favorable maritime conditions support both Satsuma mandarins and late-maturity citrus varieties.

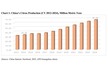

Within this structure, Satsuma mandarins account for the majority of Japan's mandarin acreage. In marketing year (MY) 2024/25, Japan harvested 46,900 hectares (ha), of which 34,500 ha belong to Satsuma orchards and 12,400 ha to late-maturing varieties. Both production types continue to shrink as growers leave agriculture or scale back orchard operations. Steep-slope orchards face particularly rapid abandonment due to labor constraints and rising input costs, and replanting initiatives are insufficient to offset national-level declines.

This contraction will continue into MY 2025/26, when total harvested area is estimated to fall to 45,700 ha, including 33,700 ha of Satsumas and 12,000 ha of late-maturing types. Although local level governments promote orchard renewal and mechanization, the pace of retirements and reduced orchard maintenance exceed the rate of new entries, thus reinforcing Japan's long-term trend of diminishing mandarin acreage.