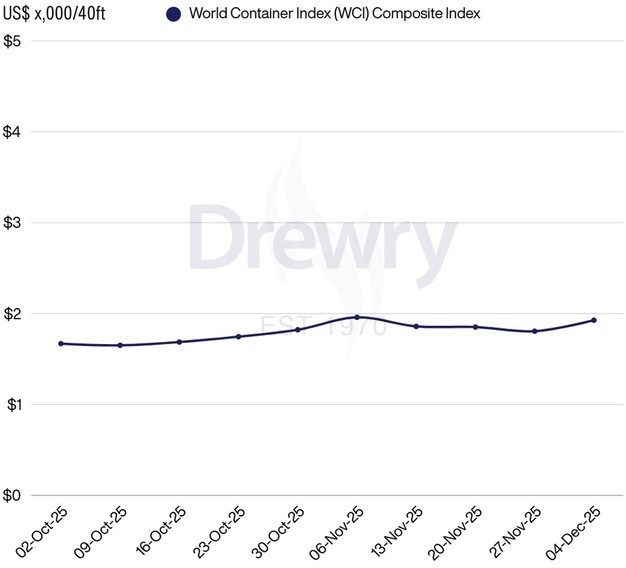

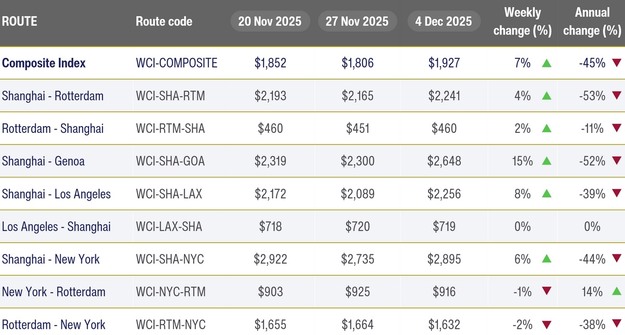

The Drewry World Container Index (WCI) rose 7% to $1,927 per 40ft container after three weeks of decline, mainly due to rate hikes on Transpacific and Asia–Europe trade routes.

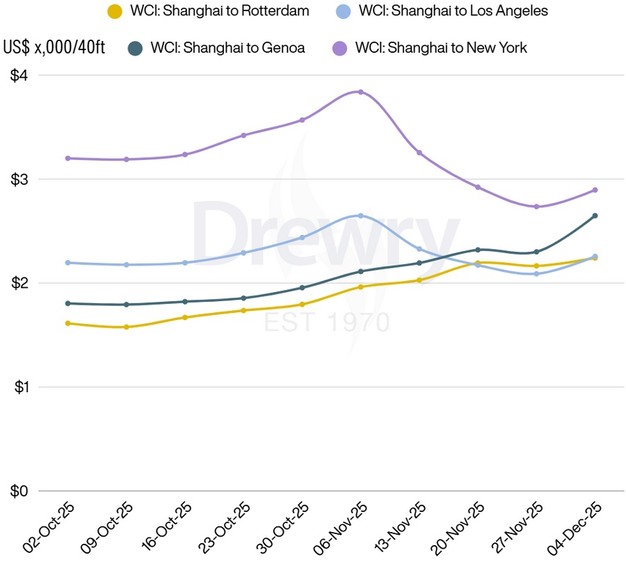

Following three weeks of declines that pushed spot rates to their lowest level since January 2025, rates on the Transpacific headhaul finally recovered this week. Spot rates from Shanghai to Los Angeles climbed 8% to $2,256 per 40ft container, while those to New York rose 6% to $2,895.

© Drewry

© Drewry

Shifting away from traditional fortnightly adjustments, some carriers have adopted a weekly strategy for GRIs. Instead of announcing large hikes that tend to erode quickly, carriers are now introducing smaller, more frequent increases to maintain consistent upwards pressure on spot rates. This strategy appears to have been effective this week, leading Drewry to forecast stable rates in the week ahead.

© Drewry

© Drewry

Spot rates on the Shanghai–Genoa route increased in double digits, rising 15% to $2,648 per 40ft container, while rates from Shanghai to Rotterdam edged up 4% to $2,241 per 40ft container. In contrast to the Transpacific trade route, Asia–Europe has successfully sustained rate levels for three consecutive weeks, leveraging FAK increases to support spot rates before annual contract talks begin.

© Drewry

© Drewry

The uncertainty surrounding the Suez Canal is adding volatility to the Asia–Europe trade lanes since carriers continue to view the Suez as the natural route between the two regions. A full resumption of transits would return significant capacity to the market and exert pressure on rates downwards, although the effect would likely be gradual due to the possible congestion at ports following the realignment of East–West networks.

© DrewryFor more information:

© DrewryFor more information:

Drewry

Tel: +44 (0) 207 538 0191

Email: [email protected]

www.drewry.co.uk