Global forecasts for tree nut production indicate increased output for almonds, walnuts, and pistachios, supported by improved growing conditions in several key producing regions.

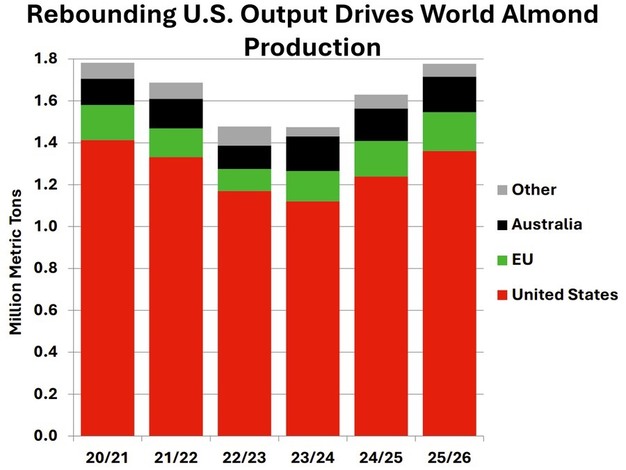

Almond production for 2025/26 is projected to rise nearly 10 per cent to 1.8 million metric tons (shelled basis), driven primarily by higher U.S. yields and smaller gains in the European Union and Australia. If achieved, it would be the highest global almond output since 2020/21. U.S. production is forecast to reach 1.4 million tons, an increase of 122,000 tons, due to mild spring temperatures and sufficient rainfall during nut development. EU output is also expected to increase, with Spain reporting higher yields after favorable weather, partly offset by reduced production in Italy.

© USDA

© USDA

Global almond exports are forecast to grow 3 per cent to 1.1 million tons. U.S. exports are expected to rise slightly to 925,000 tons, while Australia's shipments are anticipated to increase by 15,000 tons to 138,000 tons. EU imports are projected to rise to 275,000 tons, and India's imports to around 180,000 tons. China's imports are expected to fall nearly 25 per cent to 100,000 tons, reflecting reduced shipments from the United States.

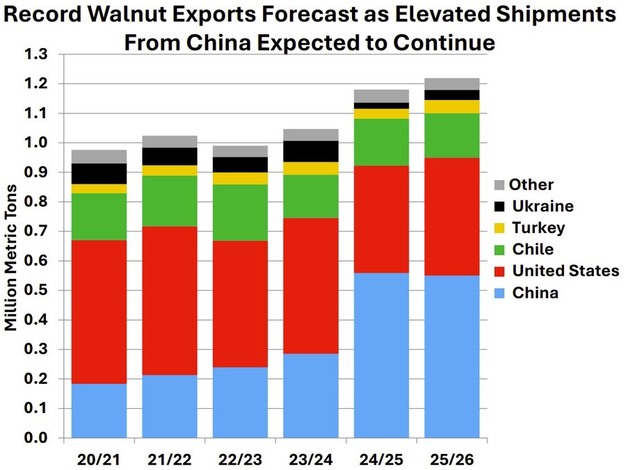

World walnut production is forecast to increase 3 per cent to 2.7 million tons (in-shell basis), largely due to a recovery in U.S. output while China, the top global producer, remains stable at 1.6 million tons. The United States is expected to harvest 644,000 tons, up nearly 100,000 tons from the previous year, supported by favorable conditions that boosted nuts per tree. China's overall production remains unchanged, with higher yields in Xinjiang offset by lower yields in Yunnan, Shanxi, and Shaanxi.

© USDA

© USDA

Walnut exports are projected to rise 3 per cent to a record 1.2 million tons. U.S. exports to India, Turkey, and the European Union are expected to support overall global growth. China's exports, which increased sharply in the previous year, are anticipated to remain high due to steady shipments to the EU and Turkey, though weaker demand is expected from the United Arab Emirates and Kyrgyzstan.

© USDA

© USDA

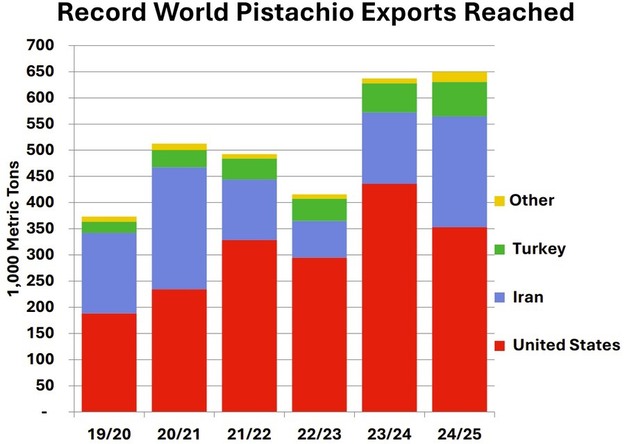

Global pistachio production for 2024/25 increased 10 per cent to a record 1.2 million tons (in-shell basis). The rise was driven by Turkey, Iran, and Syria entering the one-year phase of the alternate-bearing cycle, which more than compensated for the decline in U.S. production during its off-year. Pistachio exports reached a record 650,000 tons. Shipments from Iran were particularly strong, while U.S. exports fell nearly 20 per cent to 350,000 tons due to reduced supplies.

To view the full report, click here.

For more information:

For more information:

USDA

Tel: +1 202 720 2791

Email: [email protected]

www.fas.usda.gov