Turkey's 2025/26 apple crop is estimated to have fallen by about 40 per cent year-on-year following adverse weather earlier in the season. Frost damage has reduced raw material availability, pushing up prices and creating a challenging environment for processors.

Because of the low volumes, apples have reportedly been added to the government's list of products requiring export registration, meaning the Ministry of Trade must approve shipment applications. Market sources, however, indicated to Expana that the industry is facing weak export prospects regardless of government measures. They expect Turkey to struggle with prices in key markets this season.

© Mintec/Expana

© Mintec/Expana

Poland, a major competitor, appears likely to record higher production. While official figures are pending, some industry estimates place Polish output at more than 4 million metric tons, up from about 3 million metric tons last year. Polish prices have trended downward as a result. A source told Expana that Turkey has "no chance of competing," citing lower-priced Polish apples and Chinese products offered to the U.S. market at competitive levels despite import tariffs.

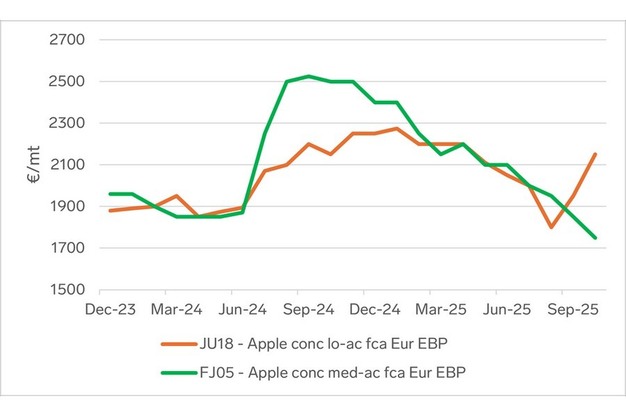

In October, Expana Benchmark Prices for apple concentrate, low acid, FCA Europe, origin Turkey, were €2,150 per metric ton, an increase of 10.3 per cent month-on-month. Apple concentrate medium acid, FCA Europe, origin Poland, was €1,750 per metric ton, down 5.4 per cent month-on-month and 30 per cent year-on-year.

Some industry participants said that one potential outlet could be demand from India for smaller or second-grade apples. They noted that lower freight rates and shorter transit times following the reopening of the Red Sea corridor may support this trade. Market sentiment remains cautious, with one source describing the season as "a complete disappointment."

Source: Mintec/Expana