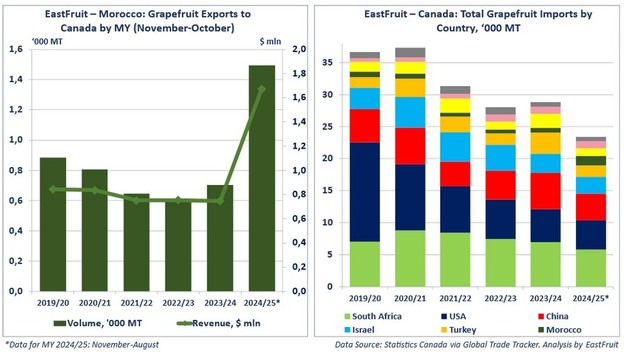

Morocco has expanded its presence in the Canadian citrus market during the 2024/25 marketing year, doubling grapefruit exports and reaching a new record volume, according to EastFruit.

Between November 2024 and August 2025, Morocco exported 1,500 metric tons of grapefruit to Canada, valued at US$1.67 million. This represents more than double the average of the previous three seasons and marks the highest level of Moroccan grapefruit exports to Canada recorded so far.

© EastFruit

© EastFruit

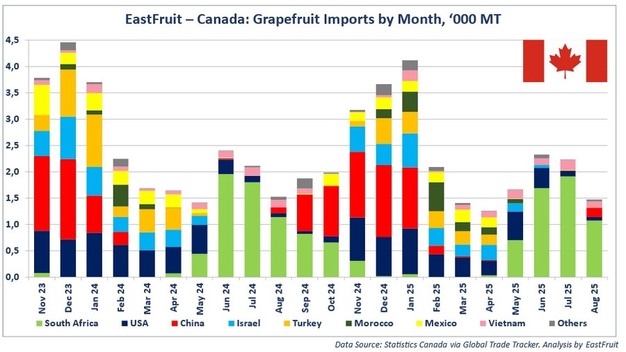

Canada remains Morocco's leading destination for grapefruit, accounting for more than 30% of the country's total grapefruit exports in 2024/25. The Moroccan export season typically runs from December through April, with peak shipments in January and February. In February 2025 alone, exports reached 500 metric tons.

Canada does not produce grapefruit commercially due to its climate and relies entirely on imports to supply domestic demand. However, national consumption has been declining for several decades. In the 1990s, Canada imported about 70,000 tons of grapefruit annually, falling to 50,000 tons in the 2000s and 40,000 tons in the 2010s. In recent years, imports have dropped below 30,000 tons, and the 2024/25 season may record a new low.

South Africa, China, and the United States remain the leading suppliers to Canada, accounting for over 60% of total imports. U.S. market share has declined in recent years, while South African exports dominate from June to August, before Chinese supplies enter the market in September. U.S. grapefruit typically arrives from November onward.

© EastFruit

© EastFruit

Consumer demand in Canada peaks between November and January, during which imports increase from Israel, Turkey, Mexico, and Morocco. From February through April, these origins dominate the market, with Moroccan grapefruit holding a 26% share in February 2025.

Morocco was one of the few exporters to increase shipments to Canada in 2024/25, countering the global downward trend in grapefruit imports. The growth aligns with a wider pattern of Moroccan expansion in Canadian produce markets, following a 17-fold increase in Moroccan blueberry exports to Canada over the past three marketing years.

Source: EastFruit