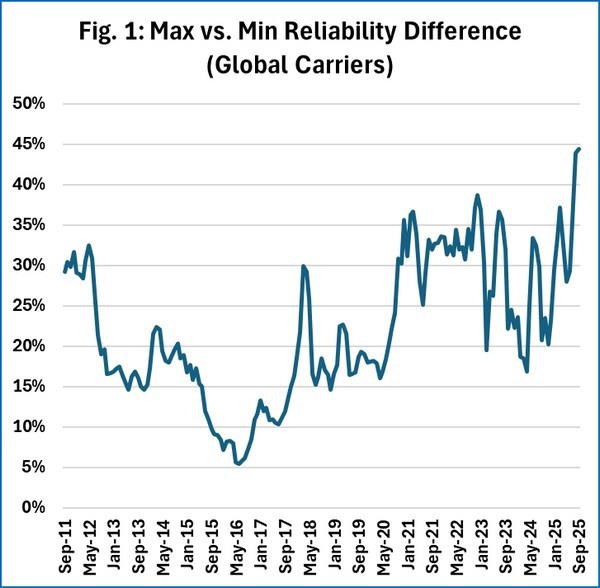

According to new analysis from Sea-Intelligence's Sunday Spotlight issue 738, the competitive landscape in global container shipping schedule reliability has shifted notably over the past decade. Despite ongoing market consolidation, performance disparities among the top 20 carriers have widened considerably since 2016, suggesting a greater variation in service levels across the industry.

The study tracked monthly schedule reliability from 2011 to 2025, using a three-month rolling average to reduce volatility. Findings show that from 2011 to 2016, the reliability gap between the best and worst performers narrowed sharply, reflecting a period when overcapacity and price competition reduced performance differentiation.

© Sea-Intelligence

© Sea-Intelligence

However, after 2016, the gap widened substantially. The difference in reliability scores increased during the pandemic and has remained high through 2024–2025. This trend indicates that shippers now face a broader range of service reliability across major carriers than before the pandemic.

Sea-Intelligence notes that this divergence has persisted even as the number of global carriers decreased due to mergers and acquisitions. The findings suggest that industry consolidation has not led to uniform service levels, with schedule reliability and vessel delays continuing to vary widely between operators.

For more information:

Alan Murphy

Sea-Intelligence

Email: [email protected], am@sea‑intelligence.com, [email protected]

www.sea-intelligence.com