In discussions with stakeholders, a recurring inquiry emerges: how much more can the demand for blueberries grow, and is there a ceiling? Currently, indications suggest a continued ascent in blueberry consumption. The fruit, renowned for its flavor, size, and transport-friendly nature, is produced year-round across various temperate and subtropical regions. It remains appealing to consumers who prioritize practicality and health benefits. Although environmental concerns regarding water usage, agrochemicals, and packaging exist, they have yet to significantly impact consumer enthusiasm for blueberries.

However, the production and commercial markets present a contrasting scenario. Historically, blueberries yielded profitable returns, propelling cultivation expansion across numerous regions. This caused a steady supply increase, yet with a setback in maintaining high price levels. Current prices have declined compared to previous years, impacting profitability.

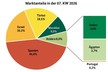

The 2024/25 Southern Hemisphere crop season exemplifies this shift. Peru, the leading blueberry exporter, rebounded from previous setbacks to break a record with over 300,000 tons exported, thanks to mature young plantations. While Peru achieved growth, other Southern Hemisphere countries faced stagnation or decline. Chile, for instance, saw exports decrease from 110,000 tons in 2017/18 and 2018/19 to around 85-90,000 tons over the past three years.

South African exports stabilized between 3-20 tons, while Argentina and Uruguay reduced shipments, transitioning to niche roles. They previously combined for 24,000 tons, now reduced to 10 tons. This reduction results from decreased profitability due to low prices and the inability to compete with Peru's advantages, forcing strategic shifts or withdrawal from the market.

Even Peru is experiencing tightening margins as low returns prompt reevaluation of business strategies, requiring efficiency improvements. Despite challenges, Peru's production is set to continue its growth. More areas are entering production, cultivation techniques are advancing, and varietal replacements aim to enhance flavor and post-harvest quality. Thus, Peru's dominance is expected to grow, with estimates projecting three out of four Southern Hemisphere blueberries originating there. Yet, prices are predicted to remain compressed, except in isolated shortage occurrences.

Source: Blueberries Consulting