It's been 10 years since Russia closed its market to all EU fruit and vegetable imports as well as other EU food products. A ban that started on August 7, 2014. In ten years, Europe's fruit and vegetable sector has been unable to compensate for the loss of this market, but it has restructured and consolidated the European market and continued to diversify exports.

A decade later, Spain has lost 20,000 hectares of peaches and nectarines and exports 17% less than in 2013. Italy lost 20,000 hectares of peach and nectarine and another 10,000 hectares of pear.

Russia has replaced stone fruit imports with Turkish exports, which have increased considerably, from 34,147 tons in 2013 to 225,959 tons in 2023.

Poland and Belgium had to drastically change their export profile, finding new destinations for the 758,000 tons of apples and 100,000 tons of pears that they sent, respectively, to the Russian market.

Russia, on the other hand, has also increased its fruit and vegetable planting area by 32% globally. Russia currently has more than 10,000 new hectares of pears and more than 50,000 hectares of apples. The new Russian apple area would be equivalent to the entire Catalan apple.

"We have come a long way since the Russian veto but it's been a costly, painful, and very complicated path. We suddenly lost a market with 150 million consumers that had a very interesting growth rate at a time when Spain was the world's leading exporter of peaches and nectarines and Catalonia accounted for 55% of those exports," stated Manel Simon, CEO of Afrucat.

It was a critical moment for peaches, nectarines, and other fruits, Simon added. "There was global pressure on the prices of all European sweet fruit. The Poles didn't know what to do with their apples. Belgium and the Netherlands had pear stocks and the Mediterranean had an excess of stone fruit. The entire sector experienced a serious crisis for three years. It was a turning point for Catalonia's fruit growing sector."

"We reinvented ourselves in record time. We had to replace Russia with an increase in domestic consumption and to strengthen trade relations with well-known countries such as Germany and Italy."

"It was a hard stage, but we came out stronger, we redefined commercial strategies, we resized companies, and -most importantly- we reinforced our nearest and main market, which is Central Europe. We also continued diversifying our exports and opening new markets. As a result, we are more prepared and more resilient."

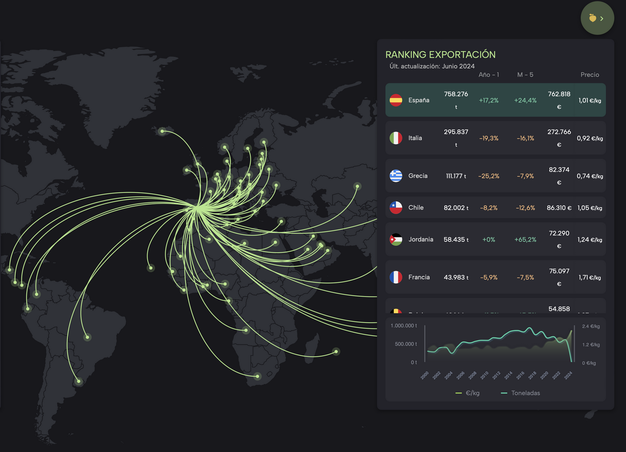

Top peach and nectarine exporters in 2013. Source: Fruitmonitor, 2024.

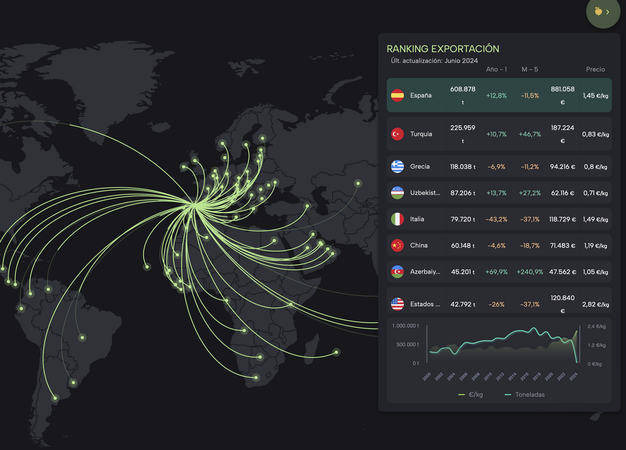

Top peach and nectarine exporters in 2023. Source: Fruitmonitor, 2024.

Top peach and nectarine exporters in 2023. Source: Fruitmonitor, 2024.

For more information:

Afrucat

www.afrucat.com